Question: When I look at the appendix it maxes out at 750-760, so I'm not sure how to do this. Marla is single and receives gross

When I look at the appendix it maxes out at 750-760, so I'm not sure how to do this.

When I look at the appendix it maxes out at 750-760, so I'm not sure how to do this.

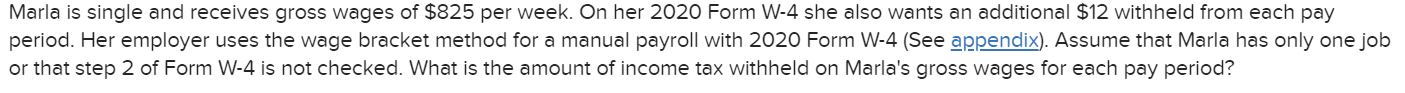

Marla is single and receives gross wages of $825 per week. On her 2020 Form W-4 she also wants an additional $12 withheld from each pay period. Her employer uses the wage bracket method for a manual payroll with 2020 Form W-4 (See appendix). Assume that Marla has only one job or that step 2 of Form W-4 is not checked. What is the amount of income tax withheld on Marla's gross wages for each pay period? Marla is single and receives gross wages of $825 per week. On her 2020 Form W-4 she also wants an additional $12 withheld from each pay period. Her employer uses the wage bracket method for a manual payroll with 2020 Form W-4 (See appendix). Assume that Marla has only one job or that step 2 of Form W-4 is not checked. What is the amount of income tax withheld on Marla's gross wages for each pay period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts