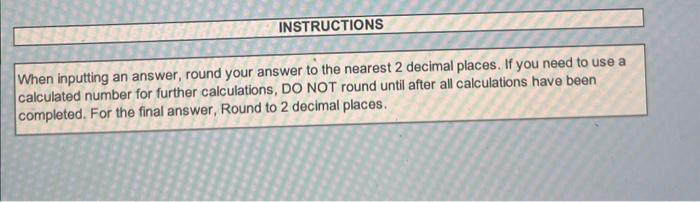

Question: When inputting an answer, round your answer to the nearest 2 decimal places. If you need to use a calculated number for further calculations, DO

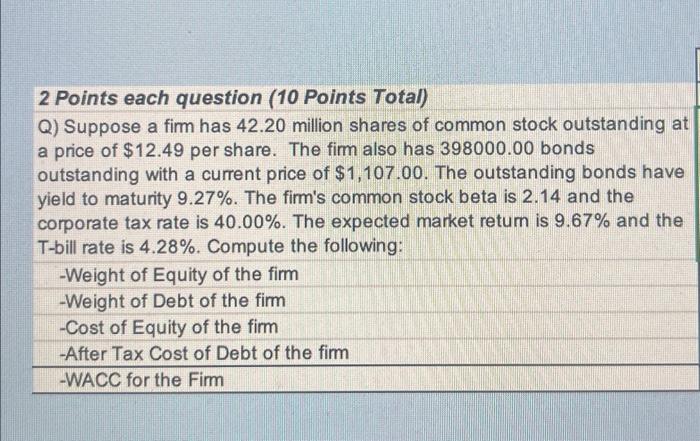

When inputting an answer, round your answer to the nearest 2 decimal places. If you need to use a calculated number for further calculations, DO NOT round until after all calculations have been completed. For the final answer, Round to 2 decimal places. 2 Points each question (10 Points Total) Q) Suppose a firm has 42.20 million shares of common stock outstanding at a price of $12.49 per share. The firm also has 398000.00 bonds outstanding with a current price of $1,107.00. The outstanding bonds have yield to maturity 9.27%. The fim's common stock beta is 2.14 and the corporate tax rate is 40.00%. The expected market retum is 9.67% and the T-bill rate is 4.28%. Compute the following: -Weight of Equity of the firm -Weight of Debt of the firm -Cost of Equity of the firm -After Tax Cost of Debt of the firm -WACC for the Firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts