Question: When is it useful to tail the hedge when using futures to hedge an existing risk exposure? Question 2 1 pts When is it useful

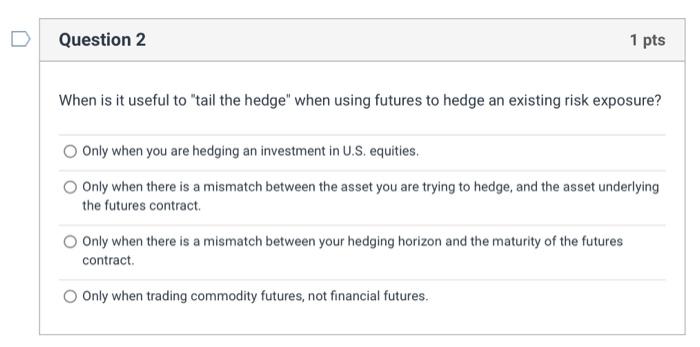

When is it useful to "tail the hedge" when using futures to hedge an existing risk exposure?

Question 2 1 pts When is it useful to "tail the hedge" when using futures to hedge an existing risk exposure? Only when you are hedging an investment in U.S. equities. Only when there is a mismatch between the asset you are trying to hedge, and the asset underlying the futures contract Only when there is a mismatch between your hedging horizon and the maturity of the futures contract. Only when trading commodity futures, not financial futures

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock