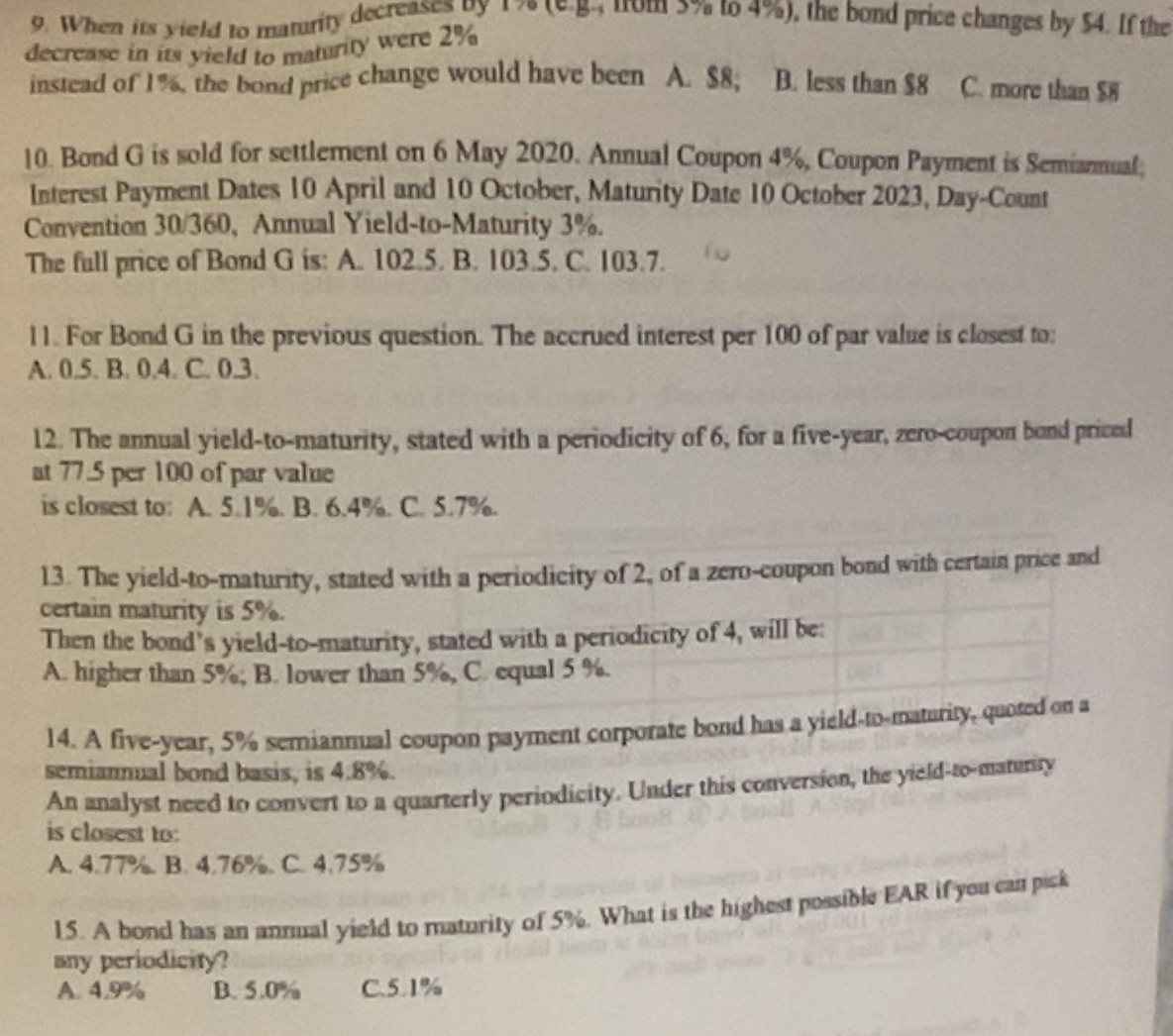

Question: When its yield to marurity decreases by decrease in its yield to matirilo were 2 % instead of 1 % , the bond price change

When its yield to marurity decreases by

decrease in its yield to matirilo were

instead of the bond price change would have been

A ;

B less than

C more thas

Bond is sold for settlement on May Annual Coupon Coupon Payment is Semiamuat;

Interest Payment Dates April and October, Maturity Date October DayCount

Convention Annual YieldtoMaturity

The full price of Bond G is: A B C

For Bond in the previous question. The accrued interest per of par value is closest to:

A

The annual yieldtomaturity, stated with a periodicity of for a fiveyear, zerocoupon bond pricel

at per of par value

is closest to: A B C

The yieldtomaturity, stated with a periodicity of of a zerocoupon bond with certain price and

certain maturity is

Then the bond's yieldtomaturity, stated with a periodicity of will be:

A higher than ; B lower than equal

A fiveyear, semiannual coupon payment corporate bond has a yieldmaturity, quoted on a

semiamnual bond basis, is

An analyst need to consent to a quanterly periodicity. Under this comversion, the yieldtomaturisy

is closest to:

A B C

A bond has an mumal yield to maturity of What is the highest possible EAR if you can pick

any periodicity?

A

B

C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock