Question: When Jane was presenting BioCom's capital budgeting techniques, a recently hired financial analyst who graduated from UIC asked bow the company arrived at 8% as

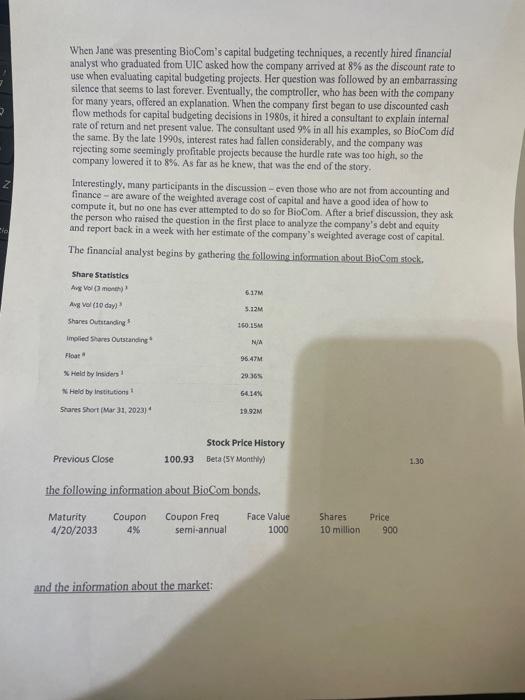

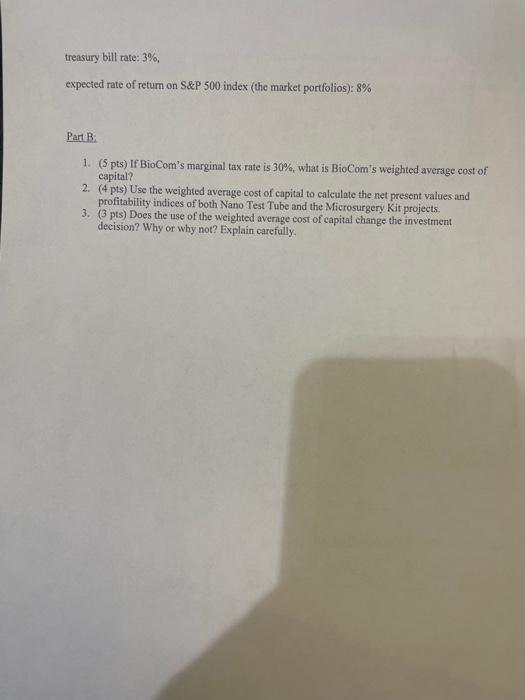

When Jane was presenting BioCom's capital budgeting techniques, a recently hired financial analyst who graduated from UIC asked bow the company arrived at 8% as the discount rate to use when evaluating capital budgeting projects. Her question was followed by an embarrassing silence that seems to last forever. Eveatually, the comptroller, who has been with the company for many years, offered an explanation. When the company first began to use discounted cash flow methods for capital budgeting decisions in 1980s, it hired a consultant to explain internal rate of return and net present value. The consaltant used 9% in all his examples, so BioCom did the same. By the late 1990 s, interest rates had fallen considerably, and the company was rejecting some seemingly profitable projects because the hurdle rate was too high, so the company lowered it to 8%. As far as be knew, that was the end of the story. Interestingly, many participants in the discussion - even those who are not from acoouating and finance - are aware of the weighted average cost of capital and have a good idea of how to compute it, but no one has ever attempted to do so for BioCom. After a brief discussion, they ask the person who raised the question in the first place to analyze the company's debt and equity and report back in a week with her estimate of the company's weighted average cost of capital. The financial analyst begins by gathering the following information about BioCam stock, the following informationabout BioCom bonds, and the information about the market: Part B 1. (5 pts) If BioCom's marginal tax rate is 30%, what is BioCom's weighted average cost of capital? 2. (4 pts) Use the weighted average cost of capital to calculate the net present values and profitability indices of both Nano Test Tube and the Microsurgery Kit projects. 3. (3 pts) Does the use of the weighted avernge cost of capital change the investment decision? Why or why not? Explain carefully. When Jane was presenting BioCom's capital budgeting techniques, a recently hired financial analyst who graduated from UIC asked bow the company arrived at 8% as the discount rate to use when evaluating capital budgeting projects. Her question was followed by an embarrassing silence that seems to last forever. Eveatually, the comptroller, who has been with the company for many years, offered an explanation. When the company first began to use discounted cash flow methods for capital budgeting decisions in 1980s, it hired a consultant to explain internal rate of return and net present value. The consaltant used 9% in all his examples, so BioCom did the same. By the late 1990 s, interest rates had fallen considerably, and the company was rejecting some seemingly profitable projects because the hurdle rate was too high, so the company lowered it to 8%. As far as be knew, that was the end of the story. Interestingly, many participants in the discussion - even those who are not from acoouating and finance - are aware of the weighted average cost of capital and have a good idea of how to compute it, but no one has ever attempted to do so for BioCom. After a brief discussion, they ask the person who raised the question in the first place to analyze the company's debt and equity and report back in a week with her estimate of the company's weighted average cost of capital. The financial analyst begins by gathering the following information about BioCam stock, the following informationabout BioCom bonds, and the information about the market: Part B 1. (5 pts) If BioCom's marginal tax rate is 30%, what is BioCom's weighted average cost of capital? 2. (4 pts) Use the weighted average cost of capital to calculate the net present values and profitability indices of both Nano Test Tube and the Microsurgery Kit projects. 3. (3 pts) Does the use of the weighted avernge cost of capital change the investment decision? Why or why not? Explain carefully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts