Question: When managers decide whether to cross-list or not, they are facing a trade-off between reducing the cost of equity capital and additional shareholder monitoring, ceteris

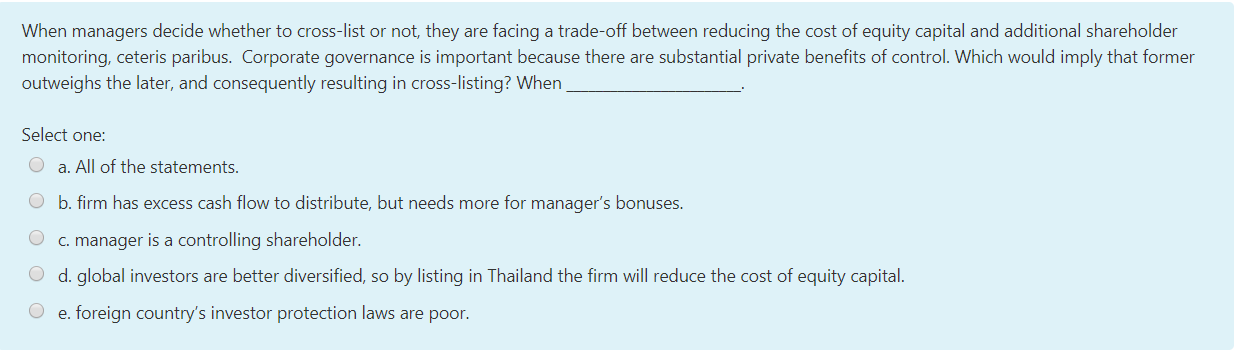

When managers decide whether to cross-list or not, they are facing a trade-off between reducing the cost of equity capital and additional shareholder monitoring, ceteris paribus. Corporate governance is important because there are substantial private benefits of control. Which would imply that former outweighs the later, and consequently resulting in cross-listing? When Select one: O a. All of the statements. O b. firm has excess cash flow to distribute, but needs more for manager's bonuses. O c. manager is a controlling shareholder. O d. global investors are better diversified, so by listing in Thailand the firm will reduce the cost of equity capital. e. foreign country's investor protection laws are poor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts