Question: When opening a new position on futures contract, a broker requires initial margin of 15% (of the initial contract size). The broker requires an

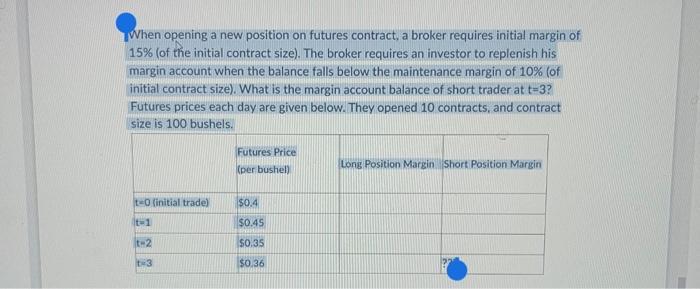

When opening a new position on futures contract, a broker requires initial margin of 15% (of the initial contract size). The broker requires an investor to replenish his margin account when the balance falls below the maintenance margin of 10% (of initial contract size). What is the margin account balance of short trader at t=3? Futures prices each day are given below. They opened 10 contracts, and contract size is 100 bushels. t-0 (initial trade) t-1 t-2 t-3 Futures Price (per bushel) $0.4 $0.45 $0.35 $0.36 Long Position Margin Short Position Margin

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Initial contract size is 10 contracts 100 bushelscontract 1000 bushel... View full answer

Get step-by-step solutions from verified subject matter experts