Question: When Patrick died he owned a $3,000,000 residence with his spouse, Patricia, as tenants by the entirety. His spouse, Patricia, paid all of the

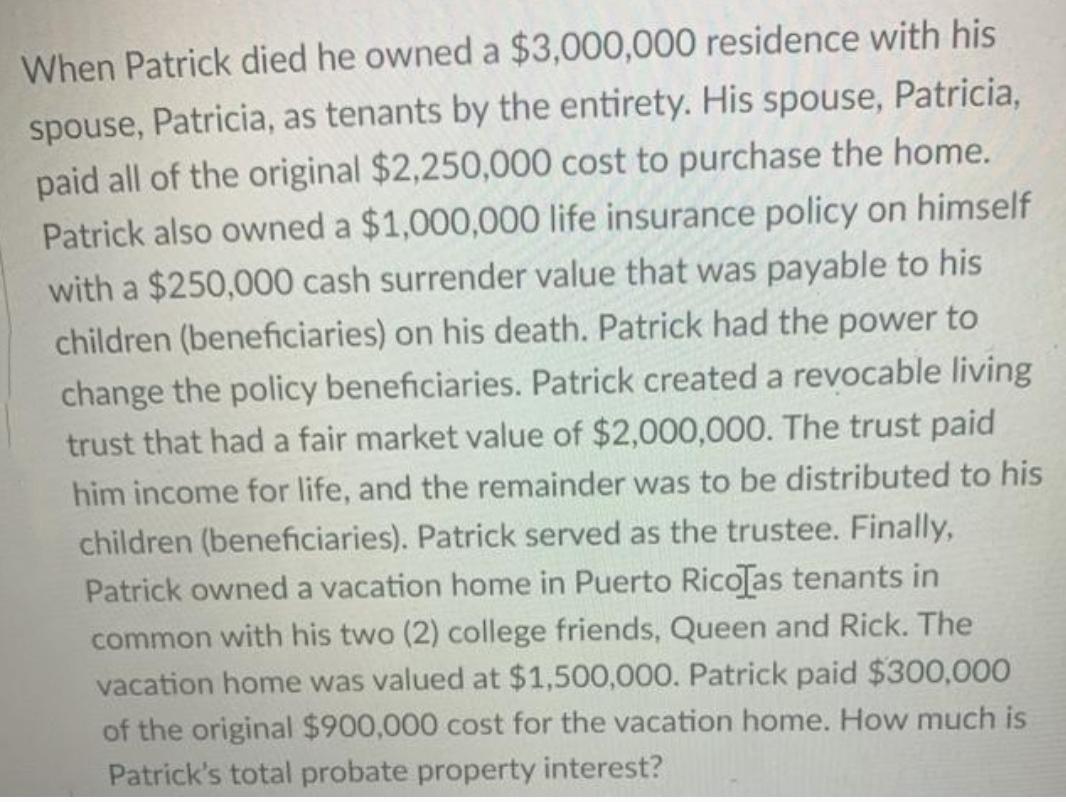

When Patrick died he owned a $3,000,000 residence with his spouse, Patricia, as tenants by the entirety. His spouse, Patricia, paid all of the original $2,250,000 cost to purchase the home. Patrick also owned a $1,000,000 life insurance policy on himself with a $250,000 cash surrender value that was payable to his children (beneficiaries) on his death. Patrick had the power to change the policy beneficiaries. Patrick created a revocable living trust that had a fair market value of $2,000,000. The trust paid him income for life, and the remainder was to be distributed to his children (beneficiaries). Patrick served as the trustee. Finally, Patrick owned a vacation home in Puerto Rico[as tenants in common with his two (2) college friends, Queen and Rick. The vacation home was valued at $1,500,000. Patrick paid $300,000 of the original $900,000 cost for the vacation home. How much is Patrick's total probate property interest?

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Patricks Probate ... View full answer

Get step-by-step solutions from verified subject matter experts