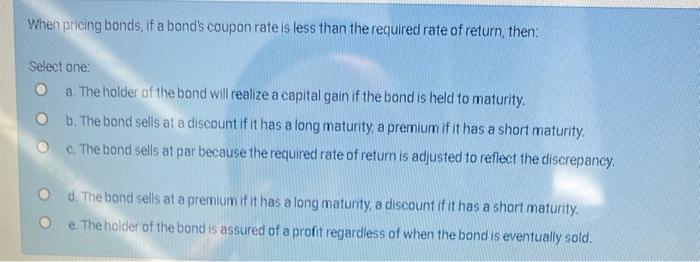

Question: When pricing bonds, if a bond's coupon rate is less than the required rate of return, then Select one: O a. The holder of the

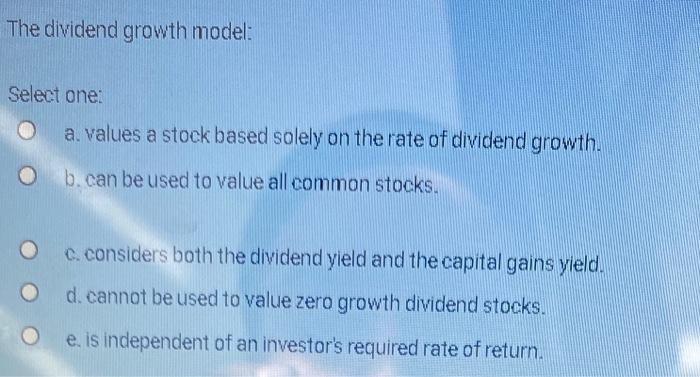

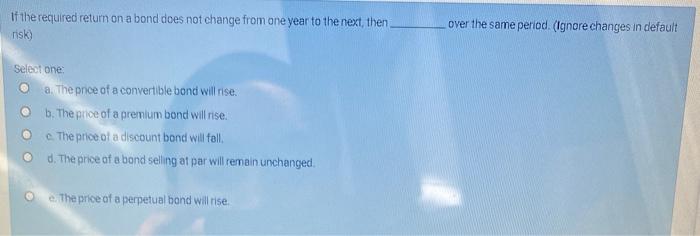

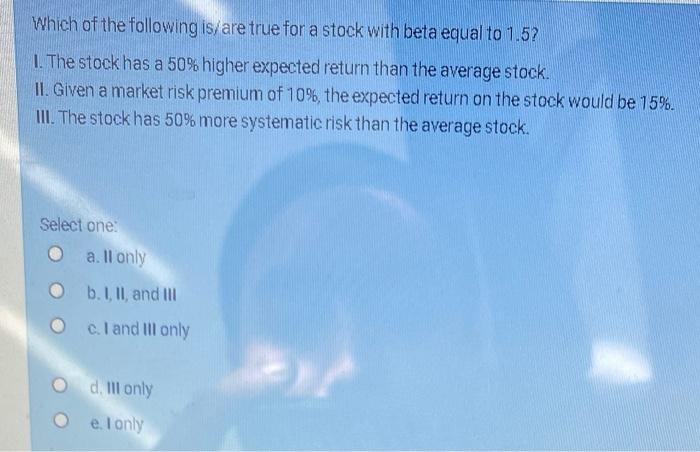

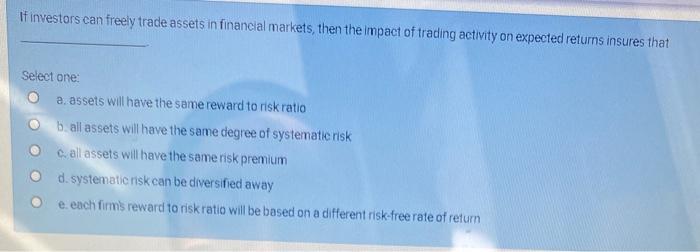

When pricing bonds, if a bond's coupon rate is less than the required rate of return, then Select one: O a. The holder of the bond will realize a capital gain if the bond is held to maturity. Ob. The bond sells at a discount if it has a long matunty, a premium if it has a short maturity c. The bond sells at par because the required rate of return is adjusted to reflect the discrepancy. Od. The bond sells at a premium if it has a long maturity, a discount if it has a short maturity Oe. The holder of the bond is assured of a profit regardless of when the bond is eventually sold. The dividend growth model: Select one: a values a stock based solely on the rate of dividend growth. b. can be used to value all common stocks. c. considers both the dividend yield and the capital gains yield. d. cannot be used to value zero growth dividend stocks. e, is independent of an investor's required rate of return. If the required return on a bond does not change from one year to the next, then risk) over the same period. (Ignore changes in default Selest one a. The price of a convertible bond will rise. b. The price of a premium bond will rise e. The price of a discount bond will tell d. The price of a bond selling at par will remain unchanged. e. The price of a perpetual bond will rise. Which of the following is/are true for a stock with beta equal to 1.5? 1. The stock has a 50% higher expected return than the average stock. 11. Given a market risk premium of 10%, the expected return on the stock would be 15%. III. The stock has 50% more systematic risk than the average stock. Select one: a. ll only b. I. II and III c. I and III only d. lll only Oe. I only If investors can freely trade assets in financial markets, then the impact of trading activity on expected returns insures that Select one: a assets will have the same reward to risk ratio b all assets will have the same degree of systematic risk call assets will have the same risk premium d. systematic risk can be diversified away e each firm's reward to riskratio will be based on a different risk-free rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts