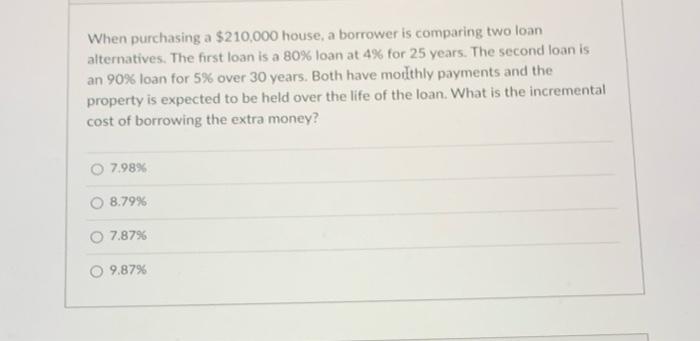

Question: When purchasing a $210,000 house, a borrower is comparing two loan alternatives. The first loan is a 80% loan at 4% for 25 years. The

When purchasing a $210,000 house, a borrower is comparing two loan alternatives. The first loan is a 80% loan at 4% for 25 years. The second loan is an 90% loan for 5% over 30 years. Both have moilthly payments and the property is expected to be held over the life of the loan. What is the incremental cost of borrowing the extra money? 7.98% 8.79% O 7.87% 9.87%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts