Question: When Ray and Conniff, general partners of the Ray Conniff Partnership who shared net income and losses in a 4:6 ratio, were incapacitated in an

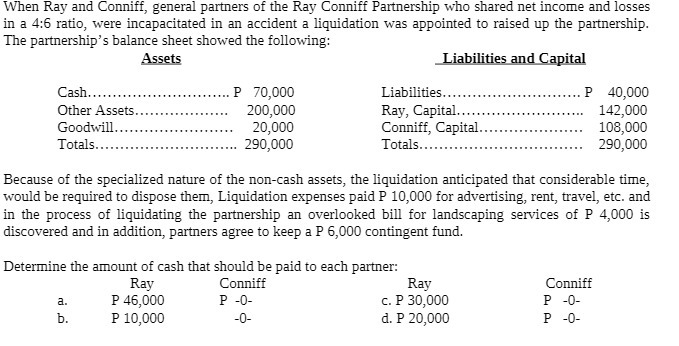

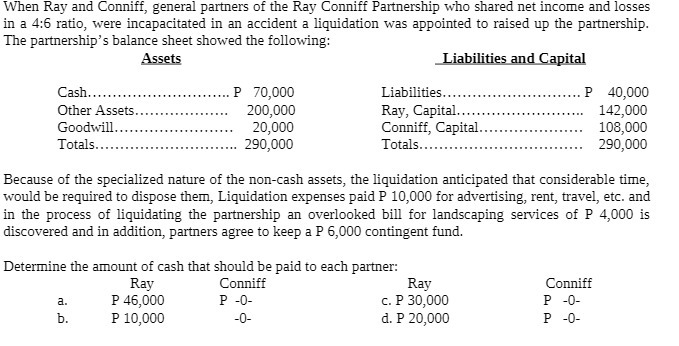

When Ray and Conniff, general partners of the Ray Conniff Partnership who shared net income and losses in a 4:6 ratio, were incapacitated in an accident a liquidation was appointed to raised up the partnership. The partnership's balance sheet showed the following: Assets Liabilities and Capital Cash.......mun P 70,000 Liabilities...... . .... 40,000 Other Assets..........I'll 200,000 Ray, Capital. ...... 142,000 Goodwill..........mmm . . 20,000 Conniff, Capital. ....... 108,000 Totals. 290,000 Totals. 290,000 Because of the specialized nature of the non-cash assets, the liquidation anticipated that considerable time, would be required to dispose them, Liquidation expenses paid P 10,000 for advertising, rent, travel, etc. and in the process of liquidating the partnership an overlooked bill for landscaping services of P 4,000 is discovered and in addition, partners agree to keep a P 6,000 contingent fund. Determine the amount of cash that should be paid to each partner: Ray Conniff Ray Conniff a. P 46,000 P -0- c. P 30,000 P -0- b. P 10,000 -0- d. P 20,000 P -0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts