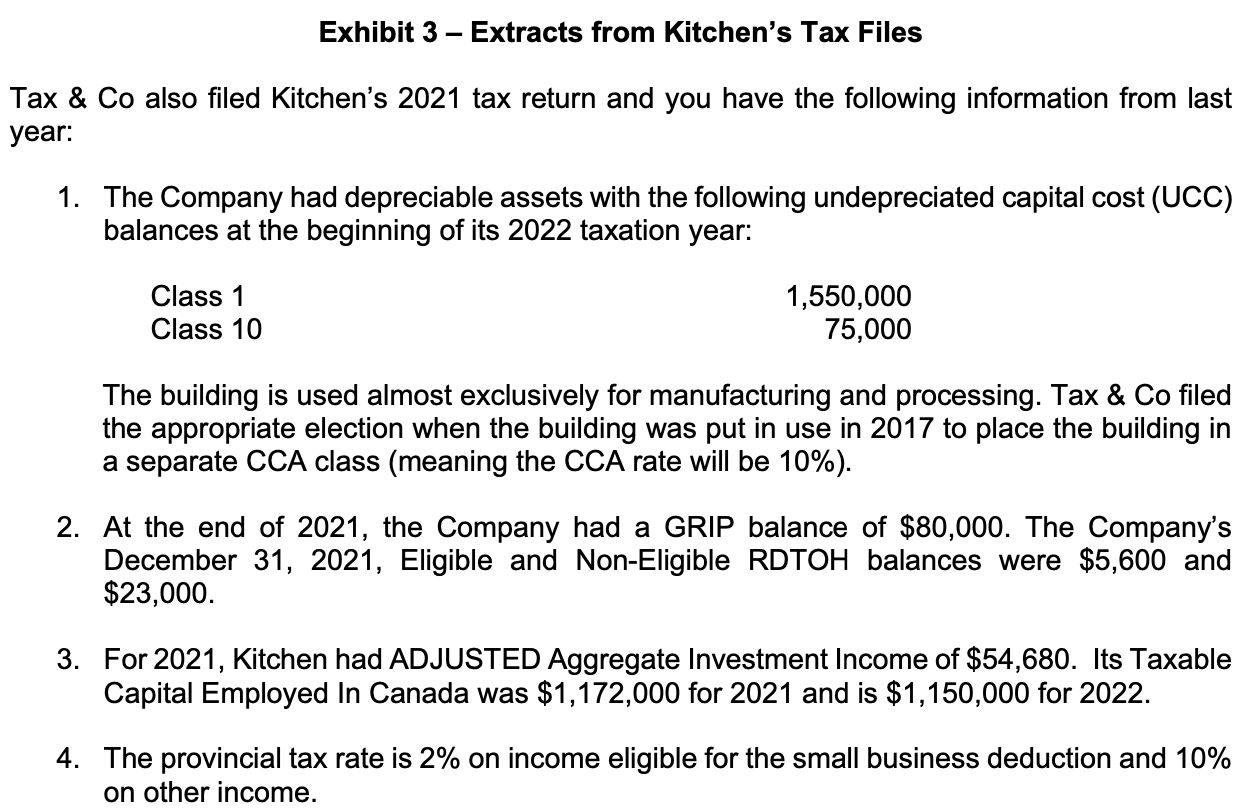

Question: When relevant, please discuss the alternatives and explain what they mean to the user. - please include the relevant tax theory to support your answer

When relevant, please discuss the alternatives and explain what they mean to the user. - please include the relevant tax theory to support your answer (specific ITA references not required). - If there are alternatives, please make sure to include a recommendation/conclusion on what you would suggest.

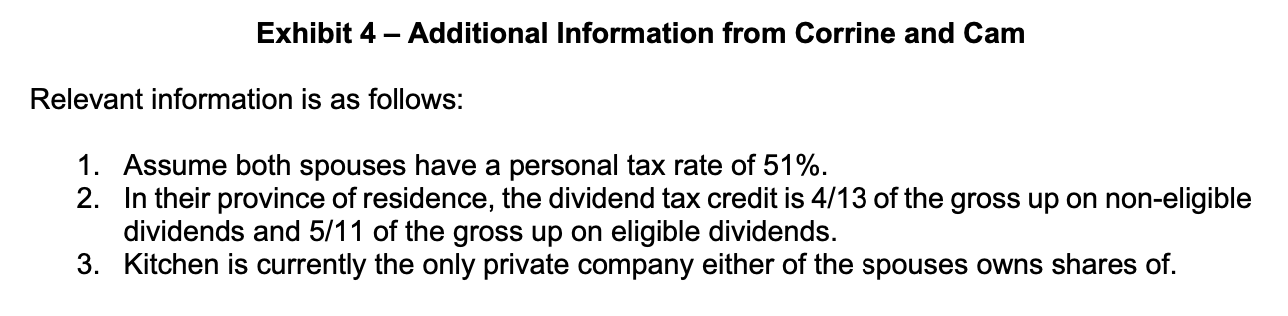

Cam: "Before we leave, I also have a question for you. As you know, even though I own some shares of Kitchen, I work full time as a chef so am not an employee of the Company. I've accumulated a significant balance in my investment portfolio and was wondering if it would be advantageous for me to create a new corporation to hold some of these investments. The

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Dear Corrine and Cam Regarding Cams question of incorporating his personal investment portfolio Creating a holding corporation could provide some tax planning benefits due to being able to split incom... View full answer

Get step-by-step solutions from verified subject matter experts