Question: When Sandy got married on October 30, 2011, she moved out of the house she had owned and lived in since September 30, 1996. She

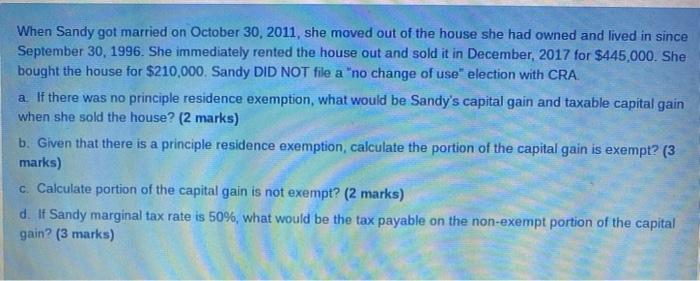

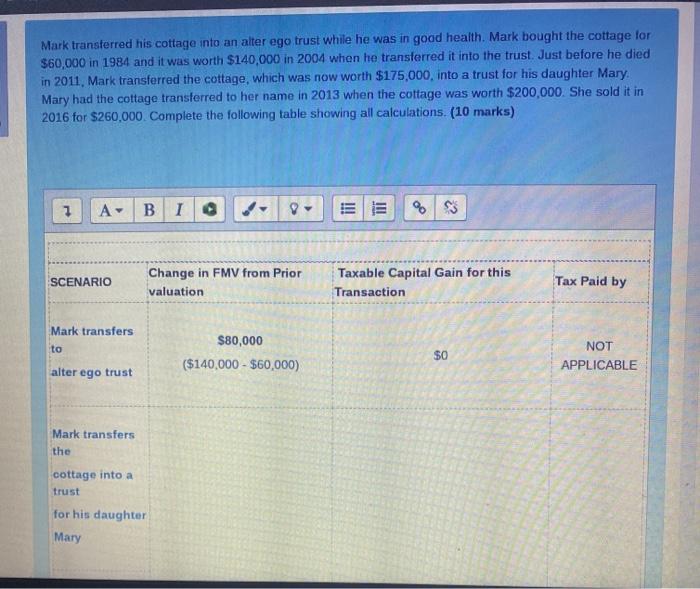

When Sandy got married on October 30, 2011, she moved out of the house she had owned and lived in since September 30, 1996. She immediately rented the house out and sold it in December, 2017 for $445,000. She bought the house for $210,000. Sandy DID NOT file a "no change of use" election with CRA a. If there was no principle residence exemption, what would be Sandy's capital gain and taxable capital gain when she sold the house? (2 marks) b. Given that there is a principle residence exemption, calculate the portion of the capital gain is exempt? (3 marks) c. Calculate portion of the capital gain is not exempt? (2 marks) d. If Sandy marginal tax rate is 50%, what would be the tax payable on the non-exempt portion of the capital gain? (3 marks) Mark transferred his cottage into an alter ego trust while he was in good health. Mark bought the cottage for $60,000 in 1984 and it was worth $140,000 in 2004 when he transferred it into the trust. Just before he died in 2011, Mark transferred the cottage, which was now worth $175,000, into a trust for his daughter Mary Mary had the cottage transferred to her name in 2013 when the cottage was worth $200,000. She sold it in 2016 for $260,000. Complete the following table showing all calculations. (10 marks) 7 B I % SCENARIO Change in FMV from Prior valuation Taxable Capital Gain for this Transaction Tax Paid by Mark transfers to $80,000 ($140,000 - $60,000) $ NOT APPLICABLE alter ego trust Mark transfers the cottage into a trust for his daughter Mary When Sandy got married on October 30, 2011, she moved out of the house she had owned and lived in since September 30, 1996. She immediately rented the house out and sold it in December, 2017 for $445,000. She bought the house for $210,000. Sandy DID NOT file a "no change of use" election with CRA a. If there was no principle residence exemption, what would be Sandy's capital gain and taxable capital gain when she sold the house? (2 marks) b. Given that there is a principle residence exemption, calculate the portion of the capital gain is exempt? (3 marks) c. Calculate portion of the capital gain is not exempt? (2 marks) d. If Sandy marginal tax rate is 50%, what would be the tax payable on the non-exempt portion of the capital gain? (3 marks) Mark transferred his cottage into an alter ego trust while he was in good health. Mark bought the cottage for $60,000 in 1984 and it was worth $140,000 in 2004 when he transferred it into the trust. Just before he died in 2011, Mark transferred the cottage, which was now worth $175,000, into a trust for his daughter Mary Mary had the cottage transferred to her name in 2013 when the cottage was worth $200,000. She sold it in 2016 for $260,000. Complete the following table showing all calculations. (10 marks) 7 B I % SCENARIO Change in FMV from Prior valuation Taxable Capital Gain for this Transaction Tax Paid by Mark transfers to $80,000 ($140,000 - $60,000) $ NOT APPLICABLE alter ego trust Mark transfers the cottage into a trust for his daughter Mary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts