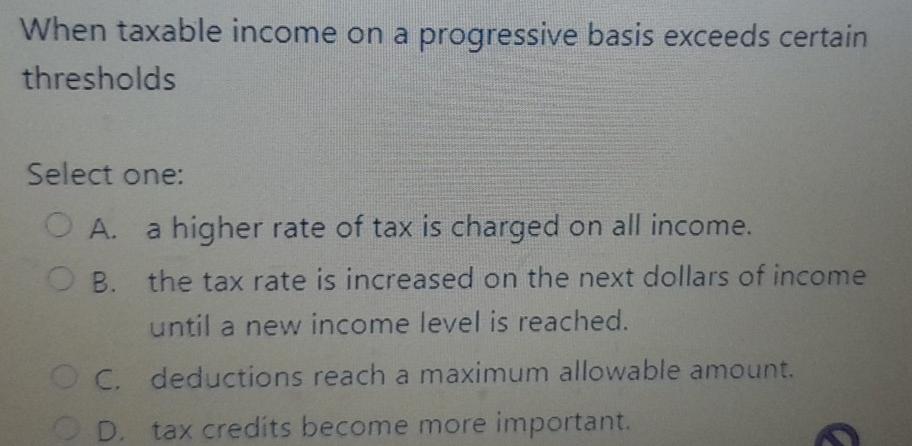

Question: When taxable income on a progressive basis exceeds certain thresholds Select one: O A. a higher rate of tax is charged on all income. O

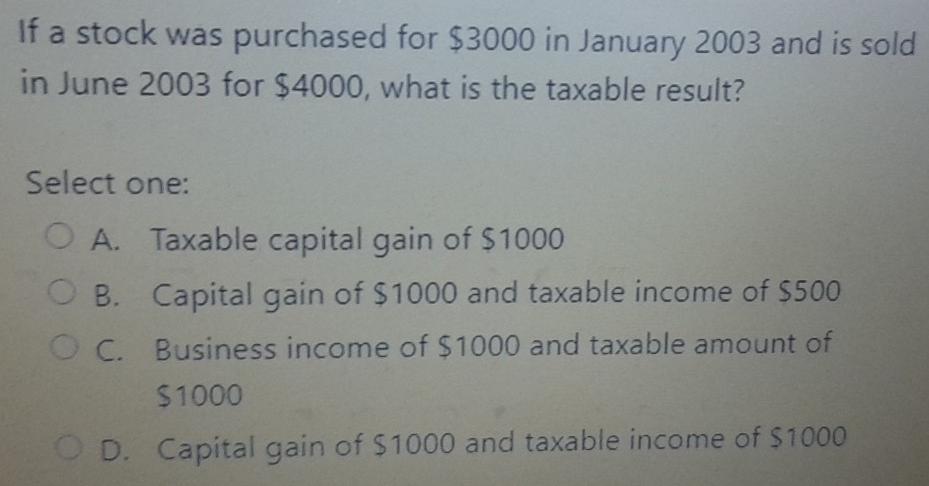

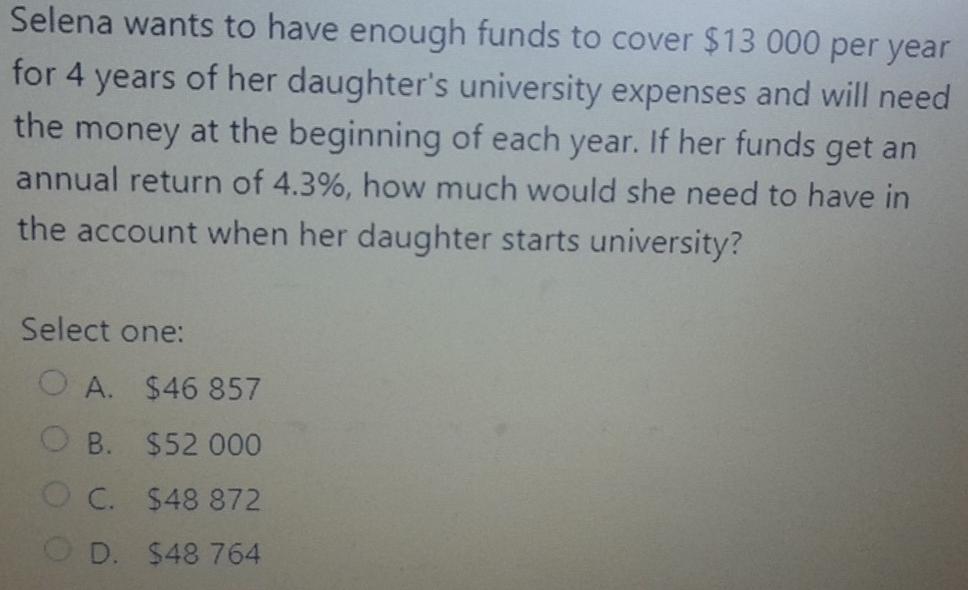

When taxable income on a progressive basis exceeds certain thresholds Select one: O A. a higher rate of tax is charged on all income. O B. the tax rate is increased on the next dollars of income until a new income level is reached. OC. deductions reach a maximum allowable amount. O D. tax credits become more important. If a stock was purchased for $3000 in January 2003 and is sold in June 2003 for $4000, what is the taxable result? Select one: O A. Taxable capital gain of $1000 B. Capital gain of $1000 and taxable income of $500 O C. Business income of $1000 and taxable amount of $1000 D. Capital gain of $1000 and taxable income of $1000 Selena wants to have enough funds to cover $13 000 per year for 4 years of her daughter's university expenses and will need the money at the beginning of each year. If her funds get an annual return of 4.3%, how much would she need to have in the account when her daughter starts university? Select one: O A. $46 857 B. $52 000 OC. 548 872 OD. $48 764

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts