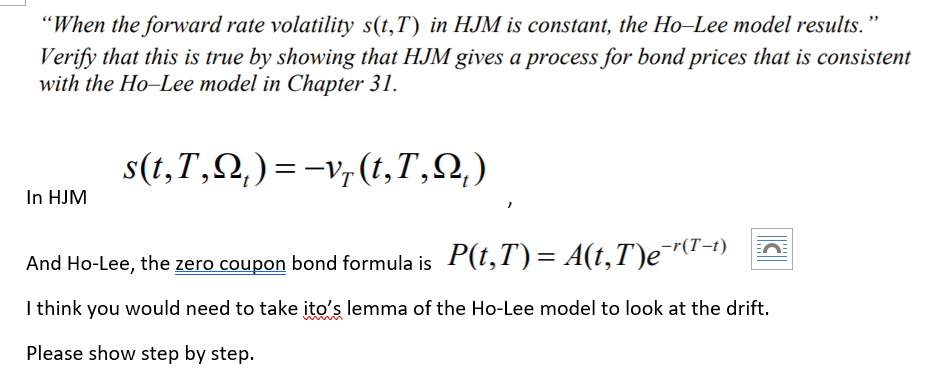

Question: When the forward rate volatility s(t,T) in HJM is constant, the Ho-Lee model results. Verify that this is true by showing that HJM gives a

When the forward rate volatility s(t,T) in HJM is constant, the Ho-Lee model results. Verify that this is true by showing that HJM gives a process for bond prices that is consistent with the Ho-Lee model in Chapter 31. s(t,7,12,)=-v,(1,7,12,) In HJM And Ho-Lee, the zero coupon bond formula is P(t,T) = Alt, T)e="(T-1) I think you would need to take ito's lemma of the Ho-Lee model to look at the drift. Please show step by step

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock