Question: When the project was first evaluated at 9%, you would have advised that the company (reject or accepts) the project because it ( added or

When the project was first evaluated at 9%, you would have advised that the company (reject or accepts) the project because it ( added or lost) value for the company. But now with an 11% interest rate, you will advise the company to (reject or accept) the project because it (added or lost) value for the company.

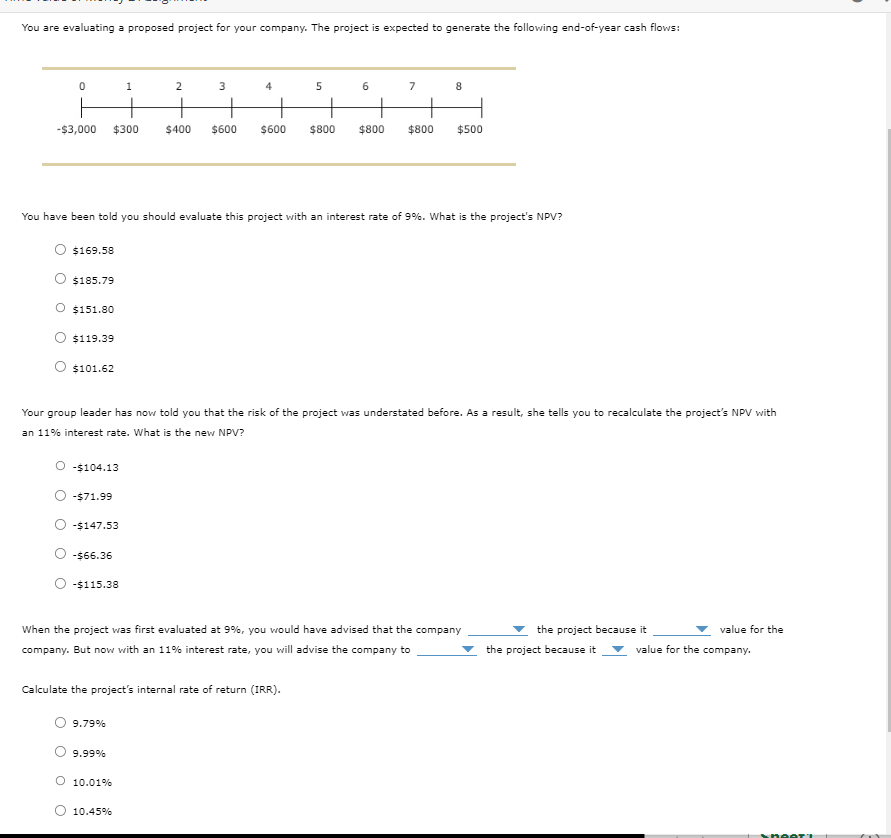

You are evaluating a proposed project for your company. The project is expected to generate the following end-of-year cash flows: You have been told you should evaluate this project with an interest rate of 9%. What is the project's NPV? $169.58 $185.79 $151.80 $119.39 $101.62 Your group leader has now told you that the risk of the project was understated before. As a result, she tells you to recalculate the project's NPV with an 11% interest rate. What is the new NPV? $104.13 $71.99 $147.53 $66.36 $115.38 When the project was first evaluated at 9%, you would have advised that the company the project because it value for the company. But now with an 11% interest rate, you will advise the company to for the company. Calculate the project's internal rate of return (IRR). 9.79% 9.99% 10.01% 10.45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts