Question: When the temporary difference due to accelerated tax depreciation is reversing, which of the following accounts will be credited in the journal entry for accruing

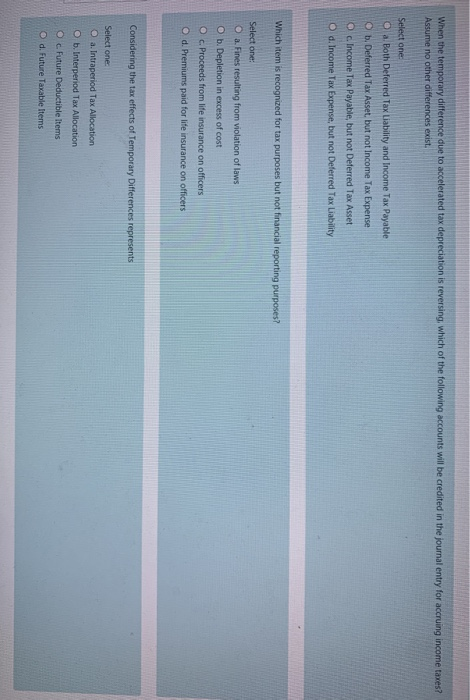

When the temporary difference due to accelerated tax depreciation is reversing, which of the following accounts will be credited in the journal entry for accruing income taxes? Assume no other differences exist. Select one O a. Both Deferred Tax Liability and Income Tax Payable O b. Deferred Tax Asset but not Income Tax Expense O c Income Tax Payable, but not Deferred Tax Asset O d. Income Tax Expense, but not Deferred Tax Liability Which item is recognized for tax purposes but not financial reporting purposes? Select one: O a. Fines resulting from violation of laws O b. Depletion in excess of cost O c. Proceeds from life insurance on officers O d. Premiums paid for life insurance on officers Considering the tax effects of Temporary Differences represents Select one O a. Intraperiod Tax Allocation O b. Interperiod Tax Allocation O c. Future Deductible Items d. Future Taxable Items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts