Question: When translating into functional currency (temporal method), fixed assets are translated using closing eading industrial organisations around the world. It operates in a market populated

When translating into functional currency (temporal method), fixed assets are translated using closing

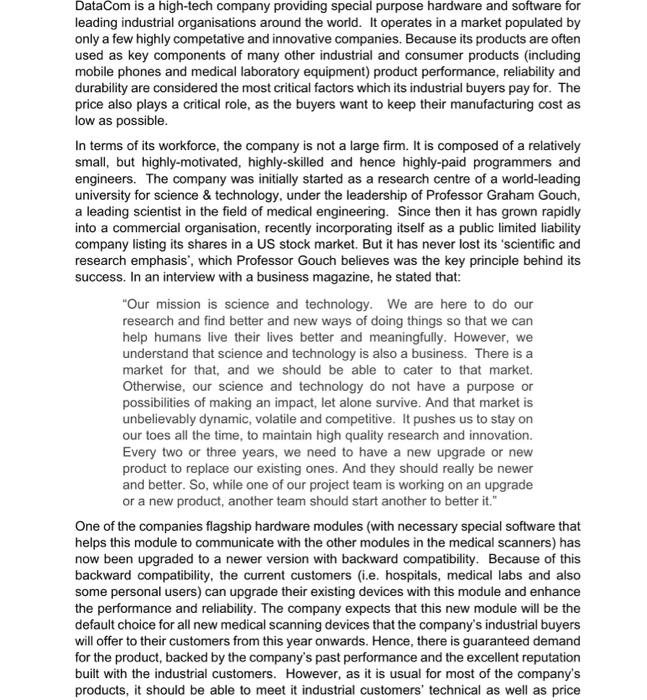

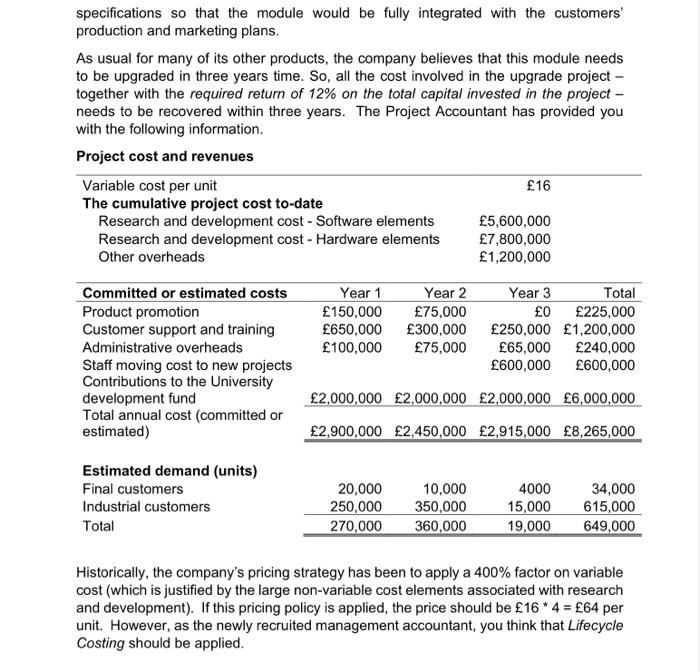

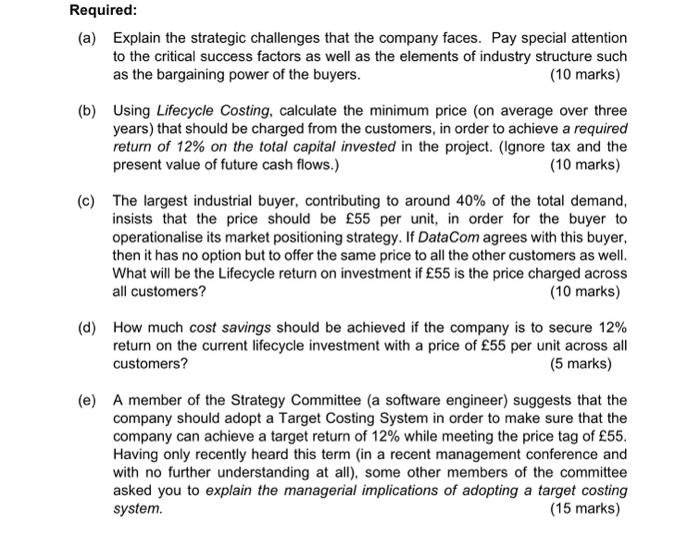

eading industrial organisations around the world. It operates in a market populated by nnly a few highly competative and innovative companies. Because its products are often used as key components of many other industrial and consumer products (including mobile phones and medical laboratory equipment) product performance, reliability and durability are considered the most critical factors which its industrial buyers pay for. The orice also plays a critical role, as the buyers want to keep their manufacturing cost as ow as possible. n terms of its workforce, the company is not a large firm. It is composed of a relatively small, but highly-motivated, highly-skilled and hence highly-paid programmers and engineers. The company was initially started as a research centre of a world-leading university for science \& technology, under the leadership of Professor Graham Gouch, a leading scientist in the field of medical engineering. Since then it has grown rapidly nto a commercial organisation, recently incorporating itself as a public limited liability company listing its shares in a US stock market. But it has never lost its 'scientific and 'esearch emphasis", which Professor Gouch believes was the key principle behind its success. In an interview with a business magazine, he stated that: "Our mission is science and technology. We are here to do our research and find better and new ways of doing things so that we can help humans live their lives better and meaningfully. However, we understand that science and technology is also a business. There is a market for that, and we should be able to cater to that market. Otherwise, our science and technology do not have a purpose or possibilities of making an impact, let alone survive. And that market is unbelievably dynamic, volatile and competitive. It pushes us to stay on our toes all the time, to maintain high quality research and innovation. Every two or three years, we need to have a new upgrade or new product to replace our existing ones. And they should really be newer and better. So, while one of our project team is working on an upgrade or a new product, another team should start another to better it." One of the companies flagship hardware modules (with necessary special software that helps this module to communicate with the other modules in the medical scanners) has now been upgraded to a newer version with backward compatibility. Because of this jackward compatibility, the current customers (i.e. hospitals, medical labs and also some personal users) can upgrade their existing devices with this module and enhance he performance and reliability. The company expects that this new module will be the default choice for all new medical scanning devices that the company's industrial buyers will offer to their customers from this year onwards. Hence, there is guaranteed demand or the product, backed by the company's past performance and the excellent reputation ouilt with the industrial customers. However, as it is usual for most of the company's oroducts, it should be able to meet it industrial customers' technical as well as price specifications so that the module would be fully integrated with the customers' production and marketing plans. As usual for many of its other products, the company believes that this module needs to be upgraded in three years time. So, all the cost involved in the upgrade project together with the required return of 12% on the total capital invested in the project needs to be recovered within three years. The Project Accountant has provided you with the following information. Historically, the company's pricing strategy has been to apply a 400% factor on variable cost (which is justified by the large non-variable cost elements associated with research and development). If this pricing policy is applied, the price should be 164=64 per unit. However, as the newly recruited management accountant, you think that Lifecycle Costing should be applied. (a) Explain the strategic challenges that the company faces. Pay special attention to the critical success factors as well as the elements of industry structure such as the bargaining power of the buyers. (10 marks) (b) Using Lifecycle Costing, calculate the minimum price (on average over three years) that should be charged from the customers, in order to achieve a required return of 12% on the total capital invested in the project. (Ignore tax and the present value of future cash flows.) (10 marks) (c) The largest industrial buyer, contributing to around 40% of the total demand, insists that the price should be 55 per unit, in order for the buyer to operationalise its market positioning strategy. If DataCom agrees with this buyer, then it has no option but to offer the same price to all the other customers as well. What will be the Lifecycle return on investment if 55 is the price charged across all customers? (10 marks) (d) How much cost savings should be achieved if the company is to secure 12% return on the current lifecycle investment with a price of 55 per unit across all customers? (5 marks) (e) A member of the Strategy Committee (a software engineer) suggests that the company should adopt a Target Costing System in order to make sure that the company can achieve a target return of 12% while meeting the price tag of 55. Having only recently heard this term (in a recent management conference and with no further understanding at all), some other members of the committee asked you to explain the managerial implications of adopting a target costing system. (15 marks) eading industrial organisations around the world. It operates in a market populated by nnly a few highly competative and innovative companies. Because its products are often used as key components of many other industrial and consumer products (including mobile phones and medical laboratory equipment) product performance, reliability and durability are considered the most critical factors which its industrial buyers pay for. The orice also plays a critical role, as the buyers want to keep their manufacturing cost as ow as possible. n terms of its workforce, the company is not a large firm. It is composed of a relatively small, but highly-motivated, highly-skilled and hence highly-paid programmers and engineers. The company was initially started as a research centre of a world-leading university for science \& technology, under the leadership of Professor Graham Gouch, a leading scientist in the field of medical engineering. Since then it has grown rapidly nto a commercial organisation, recently incorporating itself as a public limited liability company listing its shares in a US stock market. But it has never lost its 'scientific and 'esearch emphasis", which Professor Gouch believes was the key principle behind its success. In an interview with a business magazine, he stated that: "Our mission is science and technology. We are here to do our research and find better and new ways of doing things so that we can help humans live their lives better and meaningfully. However, we understand that science and technology is also a business. There is a market for that, and we should be able to cater to that market. Otherwise, our science and technology do not have a purpose or possibilities of making an impact, let alone survive. And that market is unbelievably dynamic, volatile and competitive. It pushes us to stay on our toes all the time, to maintain high quality research and innovation. Every two or three years, we need to have a new upgrade or new product to replace our existing ones. And they should really be newer and better. So, while one of our project team is working on an upgrade or a new product, another team should start another to better it." One of the companies flagship hardware modules (with necessary special software that helps this module to communicate with the other modules in the medical scanners) has now been upgraded to a newer version with backward compatibility. Because of this jackward compatibility, the current customers (i.e. hospitals, medical labs and also some personal users) can upgrade their existing devices with this module and enhance he performance and reliability. The company expects that this new module will be the default choice for all new medical scanning devices that the company's industrial buyers will offer to their customers from this year onwards. Hence, there is guaranteed demand or the product, backed by the company's past performance and the excellent reputation ouilt with the industrial customers. However, as it is usual for most of the company's oroducts, it should be able to meet it industrial customers' technical as well as price specifications so that the module would be fully integrated with the customers' production and marketing plans. As usual for many of its other products, the company believes that this module needs to be upgraded in three years time. So, all the cost involved in the upgrade project together with the required return of 12% on the total capital invested in the project needs to be recovered within three years. The Project Accountant has provided you with the following information. Historically, the company's pricing strategy has been to apply a 400% factor on variable cost (which is justified by the large non-variable cost elements associated with research and development). If this pricing policy is applied, the price should be 164=64 per unit. However, as the newly recruited management accountant, you think that Lifecycle Costing should be applied. (a) Explain the strategic challenges that the company faces. Pay special attention to the critical success factors as well as the elements of industry structure such as the bargaining power of the buyers. (10 marks) (b) Using Lifecycle Costing, calculate the minimum price (on average over three years) that should be charged from the customers, in order to achieve a required return of 12% on the total capital invested in the project. (Ignore tax and the present value of future cash flows.) (10 marks) (c) The largest industrial buyer, contributing to around 40% of the total demand, insists that the price should be 55 per unit, in order for the buyer to operationalise its market positioning strategy. If DataCom agrees with this buyer, then it has no option but to offer the same price to all the other customers as well. What will be the Lifecycle return on investment if 55 is the price charged across all customers? (10 marks) (d) How much cost savings should be achieved if the company is to secure 12% return on the current lifecycle investment with a price of 55 per unit across all customers? (5 marks) (e) A member of the Strategy Committee (a software engineer) suggests that the company should adopt a Target Costing System in order to make sure that the company can achieve a target return of 12% while meeting the price tag of 55. Having only recently heard this term (in a recent management conference and with no further understanding at all), some other members of the committee asked you to explain the managerial implications of adopting a target costing system. (15 marks)