Question: When using derivative for speculation and hedging, which of the following is FALSE? In the case of options contract, traders buy call option on the

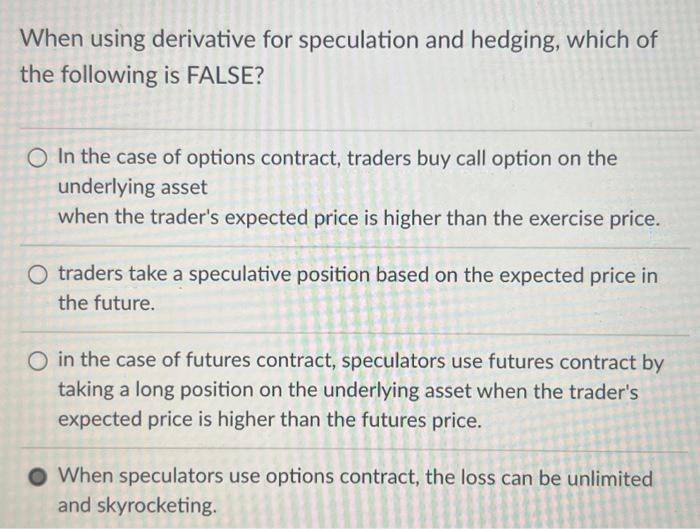

When using derivative for speculation and hedging, which of the following is FALSE? In the case of options contract, traders buy call option on the underlying asset when the trader's expected price is higher than the exercise price. traders take a speculative position based on the expected price in the future. in the case of futures contract, speculators use futures contract by taking a long position on the underlying asset when the trader's expected price is higher than the futures price. When speculators use options contract, the loss can be unlimited and skyrocketing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts