Question: When using growing annuity formulas, the most important thing is to remember the order of operations. If trying to do the whole formula in one

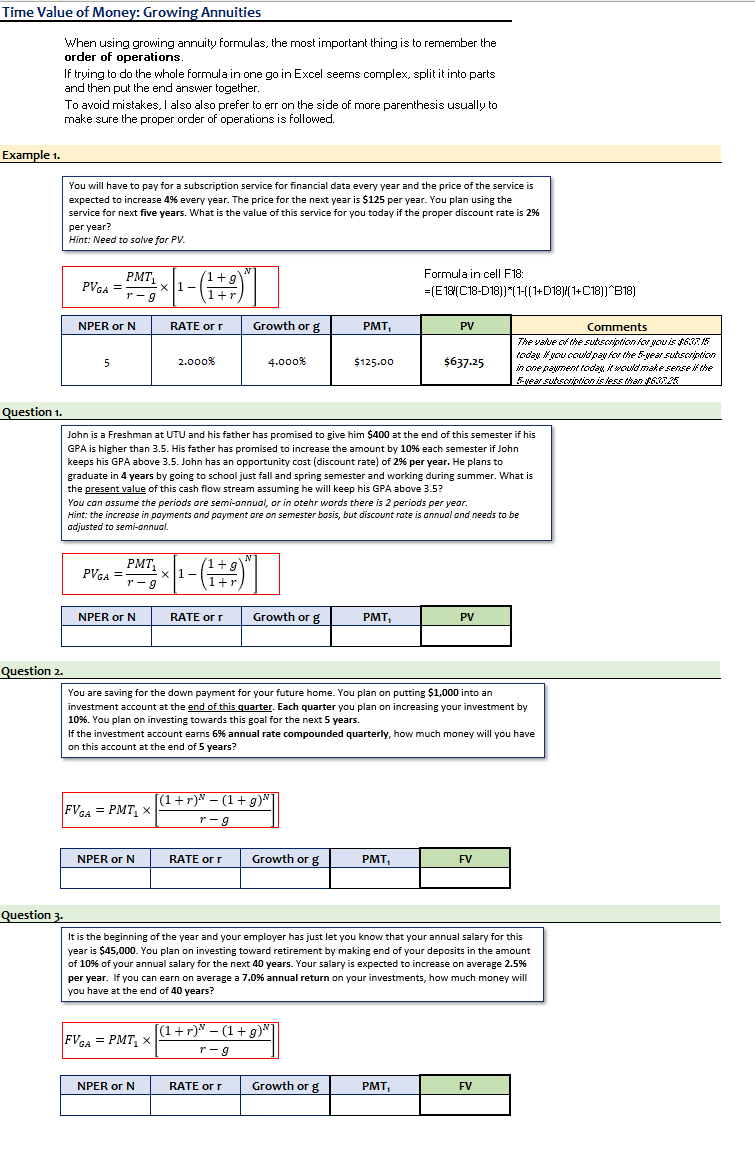

When using growing annuity formulas, the most important thing is to remember the order of operations. If trying to do the whole formula in one go in Excel seems complex, split it into parts and then put the end answer together. To avoid mistakes, I also also prefer to err on the side of more parenthesis usually to make sure the proper order of operations is followed. nple 1. You will have to pay for a subscription service for financial data every year and the price of the service is expected to increase 4% every year. The price for the next year is $125 per year. You plan using the service for next five years. What is the value of this service for you today if the proper discount rate is 2% per year? Hint: Need to solve for PV. PVGA=rgPMT1[1(1+r1+g)N] Formula in cell F18: =(E1Q(C18D18))[1([1+D18),(1+C18))B18) stion 1. John is a Freshman at UTU and his father has promised to give him $400 at the end of this semester if his GPA is higher than 3.5. His father has promised to increase the amount by 10% each semester if John keeps his GPA above 3.5. John has an opportunity cost (discount rate) of 2% per year. He plans to graduate in 4 years by going to school just fall and spring semester and working during summer. What is the present value of this cash flow stream assuming he will keep his GPA above 3.5 ? You can assume the periods are semi-annual, or in otehr words there is 2 periods per year. Hint: the increase in payments and payment are on semester basis, but discount rote is annual and needs to be adjusted to semi-annual. PVGA=rgPMT1[1(1+r1+g)N] stion 2. You are saving for the down payment for your future home. You plan on putting $1,000 into an investment account at the end of this quarter. Each quarter you plan on increasing your investment by 10\%. You plan on investing towards this goal for the next 5 years. If the investment account earns 6% annual rate compounded quarterly, how much money will you have on this account at the end of 5 years? FVGA=PMT1[rg(1+r)N(1+g)N] stion 3. It is the beginning of the year and your employer has just let you know that your annual salary for this year is $45,000. You plan on investing toward retirement by making end of your deposits in the amount of 10% of your annual salary for the next 40 years. Your salary is expected to increase on average 2.5% per year. If you can earn on average a 7.0% annual return on your investments, how much money will you have at the end of 40 years? FVGA=PMT1[rg(1+r)N(1+g)N]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts