Question: When using the corporate valuation model You can only use the corporate valuation model (CVM) to calculate a value for the entire company. The CVM

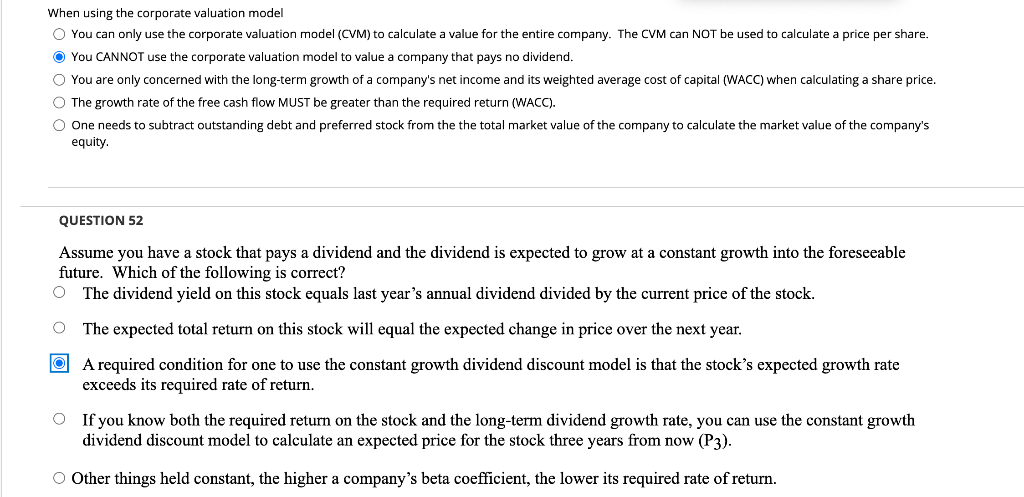

When using the corporate valuation model You can only use the corporate valuation model (CVM) to calculate a value for the entire company. The CVM can NOT be used to calculate a price per share. You CANNOT use the corporate valuation model to value a company that pays no dividend. You are only concerned with the long-term growth of a company's net income and its weighted average cost of capital (WACC) when calculating a share price. The growth rate of the free cash flow MUST be greater than the required return (WACC). One needs to subtract outstanding debt and preferred stock from the the total market value of the company to calculate the market value of the company's equity QUESTION 52 Assume you have a stock that pays a dividend and the dividend is expected to grow at a constant growth into the foreseeable future. Which of the following is correct? O The dividend yield on this stock equals last year's annual dividend divided by the current price of the stock. The expected total return on this stock will equal the expected change in price over the next year. O A required condition for one to use the constant growth dividend discount model is that the stock's expected growth rate exceeds its required rate of return. If you know both the required return on the stock and the long-term dividend growth rate, you can use the constant growth dividend discount model to calculate an expected price for the stock three years from now (P3). Other things held constant, the higher a company's beta coefficient, the lower its required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts