Question: When using the current rate method, the translation adjustment from translating a foreign subsidiary's financial statements should be shown as A) An asset or liability

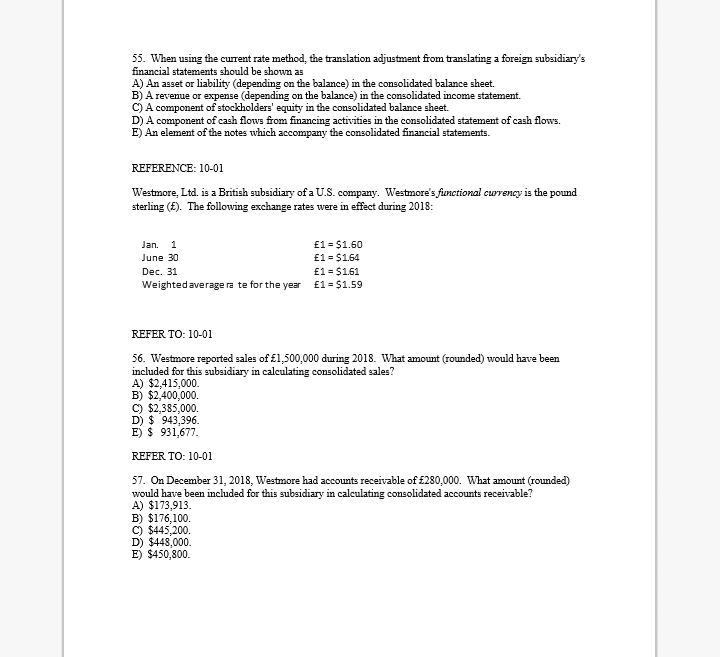

When using the current rate method, the translation adjustment from translating a foreign subsidiary's financial statements should be shown as A) An asset or liability (depending on the balance) in the consolidated balance sheet. B) A revenue or expense (depending on the balance) in the consolidated income statement. C) A component of stockholders' equity in the consolidated balance sheet. D) A component of cash flows from financing activities in the consolidated statement of cash flows. E) An element of the notes which accompany the consolidated financial statements. Westmore, Ltd. is a British subsidiary of a U.S. company. Westmore's functional currency is the pound sterling (pound). The following exchange rates were in effect during 2018: Jan. 1 pound 1 = 51.60 June 30 pound 1 = $1.64 Dec. 31 pound 1 = $1.61 Weighted average rate for the year pound 1 = $1.59 Westmore reported sales of pound 1, 500,000 during 2018. What amount (rounded) would have been included for this subsidiary in calculating consolidated sales? A) $2, 415,000. B) $2, 400,000. C) $2, 385,000. D) $943.396. E) $931, 677. On December 31, 2018, Westmore had accounts receivable of pound 280,000. What amount (rounded) would have been included for this subsidiary in calculating consolidated accounts receivable? A) $173, 913. B) $176, 100. C) $445, 200. D) $448,000. E) 5450, 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts