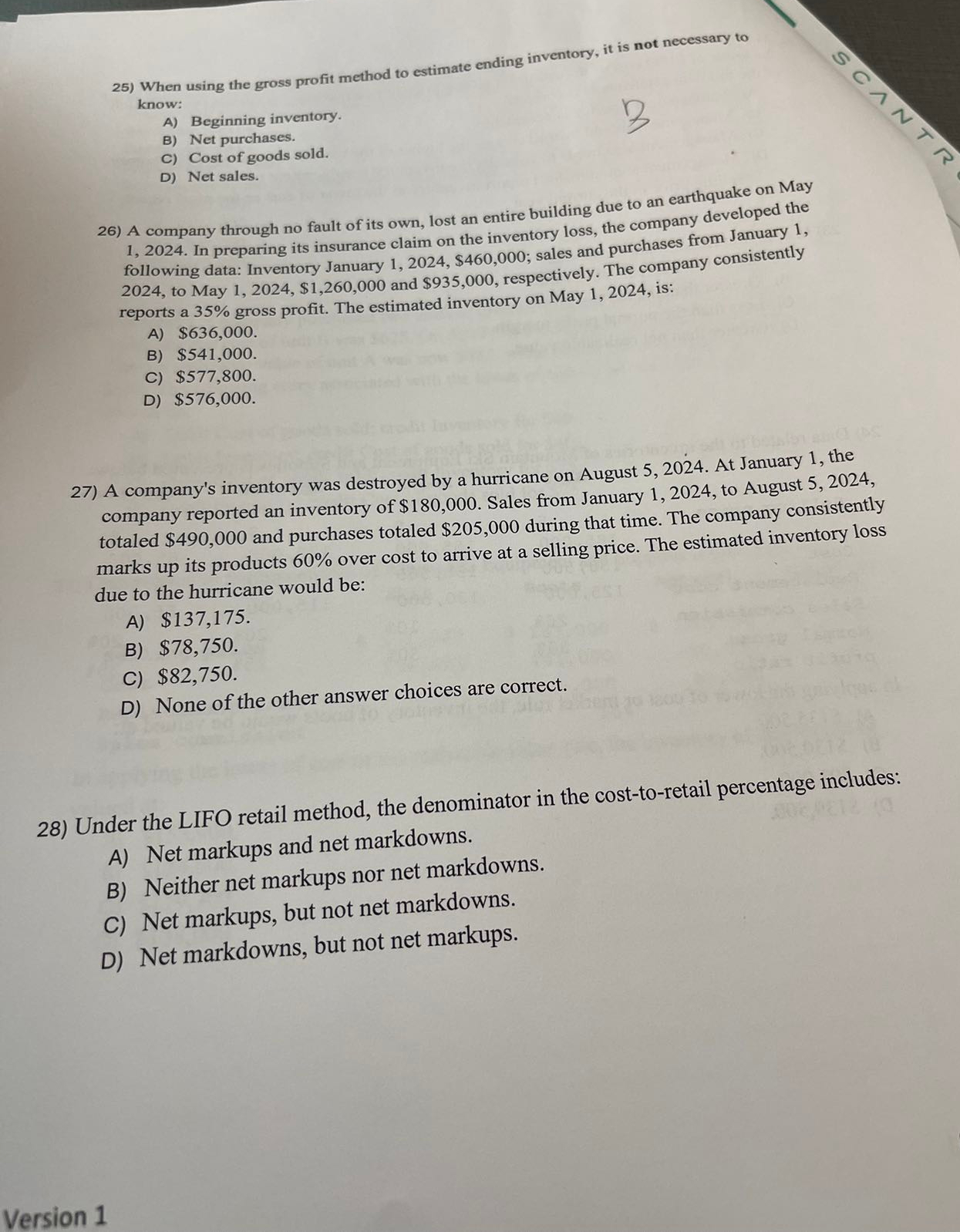

Question: When using the gross profit method to estimate ending inventory, it is not necessary to know: A ) Beginning inventory. B ) Net purchases. C

When using the gross profit method to estimate ending inventory, it is not necessary to

know:

A Beginning inventory.

B Net purchases.

C Cost of goods sold.

D Net sales.

A company through no fault of its own, lost an entire building due to an earthquake on May

In preparing its insurance claim on the inventory loss, the company developed the

following data: Inventory January $; sales and purchases from January

to May $ and $ respectively. The company consistently

reports a gross profit. The estimated inventory on May is:

A $

B $

C $

D $

A company's inventory was destroyed by a hurricane on August At January the

company reported an inventory of $ Sales from January to August

totaled $ and purchases totaled $ during that time. The company consistently

marks up its products over cost to arrive at a selling price. The estimated inventory loss

due to the hurricane would be:

A $

B $

C $

D None of the other answer choices are correct.

Under the LIFO retail method, the denominator in the costtoretail percentage includes:

A Net markups and net markdowns.

B Neither net markups nor net markdowns.

C Net markups, but not net markdowns.

D Net markdowns, but not net markups.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock