Question: When using the indirect method to prepare the operating section of a statement cash flows, which of the following is deducted from net income to

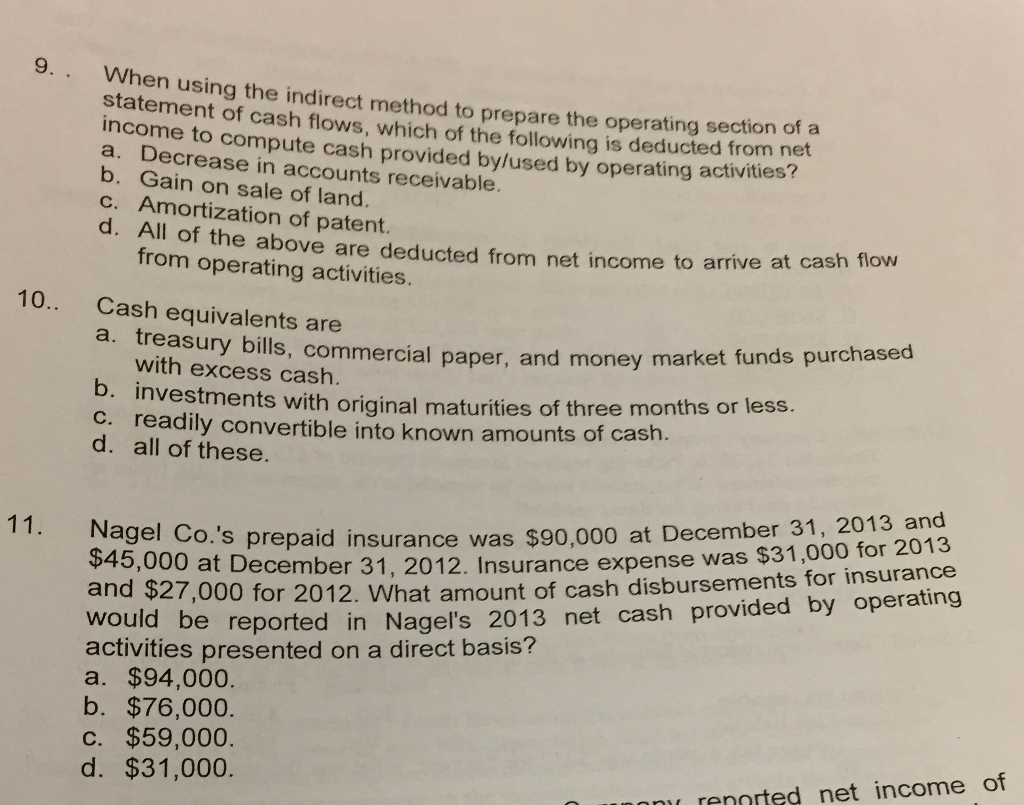

When using the indirect method to prepare the operating section of a statement cash flows, which of the following is deducted from net income to compute cash provided by used by operating activities? Decrease in accounts receivable. Gain on sale of land. Amortization of patent. All of the above are deducted from net income to arrive at cash flow from operating activities. Cash equivalents are treasury bills, commercial paper, and money market funds purchased with excess cash. investments with original maturities or less of three months. readily convertible into known amounts of cash. all of these. Nagel Co.'s was prepaid insurance $90,000 at December 31, 2013 and $45,000 at December 31, 2012. Insurance expense was $31,000 for 2013 and $27,000 for 2012. What amount of cash disbursements for insurance would be reported in Nagel's 2013 net cash provided by operating activities presented on a direct basis? $94,000. $76,000. $59,000. $31,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts