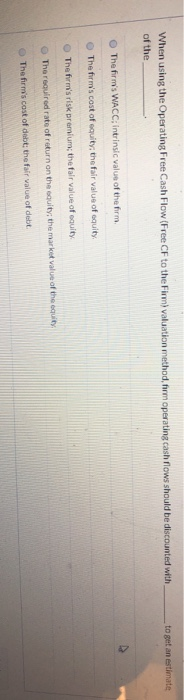

Question: When using the Operating Free Cash Flow (Free CF to the Fimi valuation method, firm operating cash flows should be discounted with to get an

When using the Operating Free Cash Flow (Free CF to the Fimi valuation method, firm operating cash flows should be discounted with to get an estimate of the The firm's WACC; intrinsic value of the firm, The firm's cost of equity, the fair value of equity, The firm's risk premium; the fair value of equity The required rate of return on the equity, the market value of the equity The firm's cost of debt the fair value of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts