Question: When valuing a stock using the constant-growth model, DI represents the: A. expected difference in the stock price over the next year. B. expected price

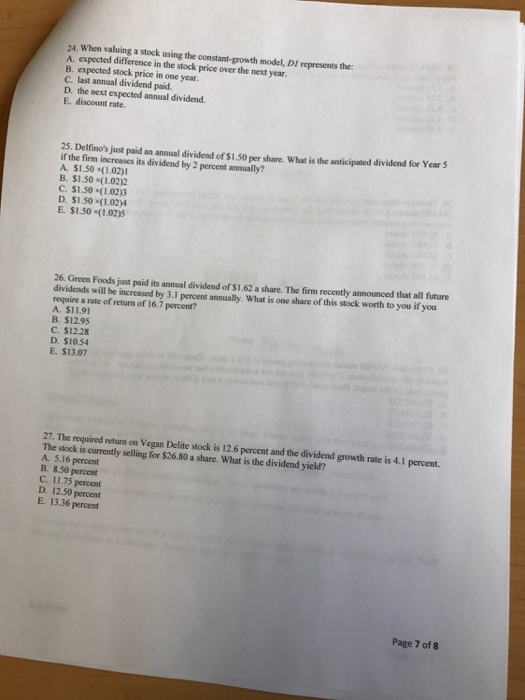

When valuing a stock using the constant-growth model, DI represents the: A. expected difference in the stock price over the next year. B. expected price in one year. c. last annual dividend paid. D. the next expected annual dividend. E. discount rate. Delfino's just paid an annual dividend of $1.50 per share. What is the anticipated dividend for Year 5 if the firm increases its dividend by 2 percent annually? A. $1.50 times (1.02)1 B. $1.50 times (1.02)2 C. $1.50 times (1.02)3 D. $1.50 times (1.02)4 E. $1.50 times (1.02)5 Green Foods just paid its annual dividend of $1.62 a share. The firm recently announced that all future dividends will be increased by 3.1 percent annually. What is one share of this stock worth to you if you require a rate of return of 16.7 percent? A. $11.91 B. $12.95 C. $12.28 D. $10.54 E. $13.07 The required return on Vegan Delite stock is 12.6 percent and the dividend growth rate is 4.1 percent. The stock is currently selling for $26.80 a share. What dividend yield? A. 5.16 percent B. 8.50 percent C. 11.75 percent D. 12.50 percent E. 13.36 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts