Question: When we are comparing two investment projects, sometimes, we may have this situation: Project X has a larger IRR, whereas Project Y has a larger

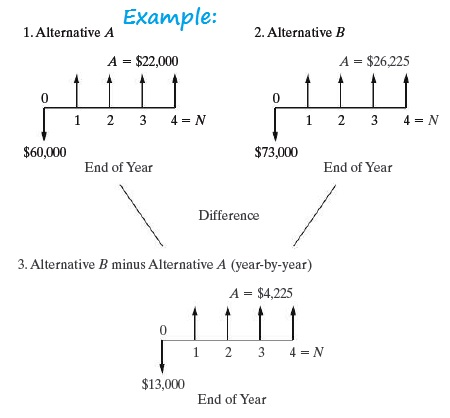

When we are comparing two investment projects, sometimes, we may have this situation: Project X has a larger IRR, whereas Project Y has a larger NPV. Hence, if ranked by IRR, Project X appears better, and if Ranking inconsistency is also the subject Background There are two investment, Project X and Project Y: The lives of the two projects are the same and equal to the study period. Each of the two projects involves making an investment now in exchange for a future stream of inflows in the form of an annuity. . Project X's IRR is larger than project Y's IRR. 1.Altermative a Example 1.Alternative A 2. Alternative B A $22,000 A $26,225 0 $60,000 $73,000 End of Year End of Year Difference 3. Alternative B minus Alternative A (year-by-year) A $4,225 0 $13,000 End of Year Required: Without calculating the NPVs (or annual worths, or future worths) of the two projects (Project X and Project Y), are there methods we can use to predict at what MARRs ranking inconsistency will occur (or put differently, to predict at what MARRs Project Y's NPV will be larger than Project X's NPV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts