Question: When we do the Exchange rate forecast, there are three theory: Interest Rate Parity (IRP), Purchasing Power Parity (PPP), and International Fisher Effect (IFE). All

When we do the Exchange rate forecast, there are three theory: Interest Rate Parity (IRP), Purchasing Power Parity (PPP), and International Fisher Effect (IFE). All these theories need interest rate of two countries to do the calculations. My question are: 1. dose the base rate the interest rate that a central bank will charge commercial banks for loans, a.k.a bank rate, base intereset rate, Could be used in the IRP calculation? 2. When using international Fisher effect to do the FX forecast, Can I use the one-year deposit rate to calculate and why? 3. The interest rate in all three theories, What kind of interest rate iare you usually used to calculate it. Is it savings rate, loan rate, or bond rate? What is your basis for choosing that type of interest rate?

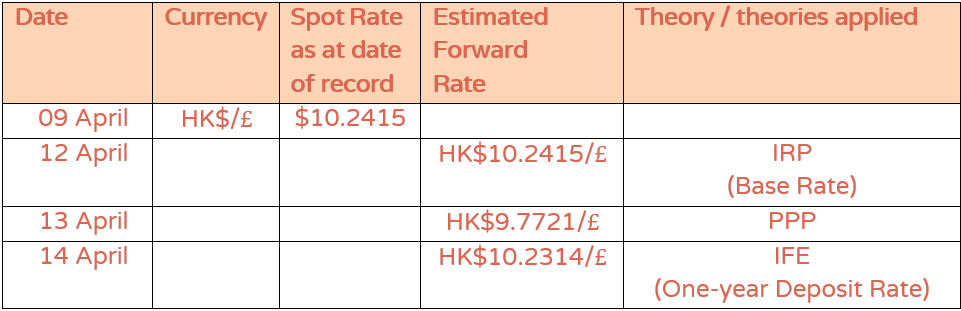

Date Theory / theories applied Currency Spot Rate as at date of record HK$/ $10.2415 Estimated Forward Rate 09 April 12 April HK$10.2415/ 13 April 14 April HK$9.7721/ HK$10.2314/ IRP (Base Rate) PPP IFE (One-year Deposit Rate) Date Theory / theories applied Currency Spot Rate as at date of record HK$/ $10.2415 Estimated Forward Rate 09 April 12 April HK$10.2415/ 13 April 14 April HK$9.7721/ HK$10.2314/ IRP (Base Rate) PPP IFE (One-year Deposit Rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts