Question: When we replace portfolio 8 with an equal-weights portfolio we get a linear relationship between beta and expected return: TRUE FALSE begin{tabular}{rrrrrrrr} portfolio & JNJ

When we replace portfolio 8 with an equal-weights portfolio we get a linear relationship between beta and expected return:

- TRUE

- FALSE

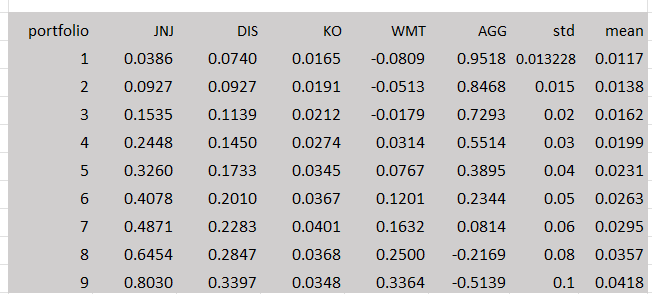

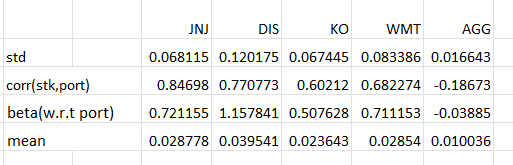

\begin{tabular}{rrrrrrrr} portfolio & JNJ & DIS & KO & WMT & AGG & std & mean \\ 1 & 0.0386 & 0.0740 & 0.0165 & -0.0809 & 0.9518 & 0.013228 & 0.0117 \\ 2 & 0.0927 & 0.0927 & 0.0191 & -0.0513 & 0.8468 & 0.015 & 0.0138 \\ 3 & 0.1535 & 0.1139 & 0.0212 & -0.0179 & 0.7293 & 0.02 & 0.0162 \\ 4 & 0.2448 & 0.1450 & 0.0274 & 0.0314 & 0.5514 & 0.03 & 0.0199 \\ 5 & 0.3260 & 0.1733 & 0.0345 & 0.0767 & 0.3895 & 0.04 & 0.0231 \\ 6 & 0.4078 & 0.2010 & 0.0367 & 0.1201 & 0.2344 & 0.05 & 0.0263 \\ 7 & 0.4871 & 0.2283 & 0.0401 & 0.1632 & 0.0814 & 0.06 & 0.0295 \\ 8 & 0.6454 & 0.2847 & 0.0368 & 0.2500 & -0.2169 & 0.08 & 0.0357 \\ 9 & 0.8030 & 0.3397 & 0.0348 & 0.3364 & -0.5139 & 0.1 & 0.0418 \end{tabular} \begin{tabular}{|l|r|r|r|r|r|} \hline & JNJ & DIS & KO & WMT & AGG \\ \hline std & 0.068115 & 0.120175 & 0.067445 & 0.083386 & 0.016643 \\ \hline corr(stk,port) & 0.84698 & 0.770773 & 0.60212 & 0.682274 & -0.18673 \\ \hline beta(w.r.t port) & 0.721155 & 1.157841 & 0.507628 & 0.711153 & -0.03885 \\ \hline mean & 0.028778 & 0.039541 & 0.023643 & 0.02854 & 0.010036 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts