Question: when you click on the 'View Summary and Submit button you will be in a summary page which allows you to go back to and

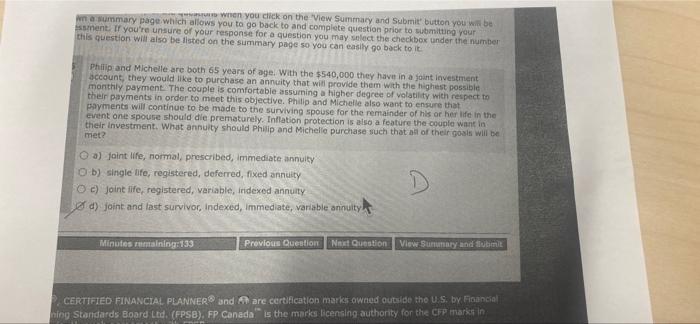

when you click on the 'View Summary and Submit button you will be in a summary page which allows you to go back to and complete question prior to submitting your essment. If you're unsure of your response for a question you may select the checkbox under the number this question will also be listed on the summary page so you can easily go back to it. Philip and Michelle are both 65 years of age. With the $540,000 they have in a joint investment account, they would like to purchase an annuity that will provide them with the highest possible monthly payment. The couple is comfortable assuming a higher degree of volatility with respect to their payments in order to meet this objective. Philip and Michelle also want to ensure that payments will continue to be made to the surviving spouse for the remainder of his or her life in the event one spouse should die prematurely. Inflation protection is also a feature the couple want in their investment. What annuity should Philip and Michelle purchase such that all of their goals will be met? Oa) joint life, normal, prescribed, immediate annuity Ob) single life, registered, deferred, fixed annuity D Oc) Joint life, registered, variable, indexed annuity d) joint and last survivor, indexed, immediate, variable annuity Minutes remaining:133 Previous Question Next Question View Sunumary and submit CERTIFIED FINANCIAL PLANNER and are certification marks owned outside the U.S. by Financial ning Standards Board Ltd. (FPSB), FP Canada is the marks licensing authority for the CFP marks in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts