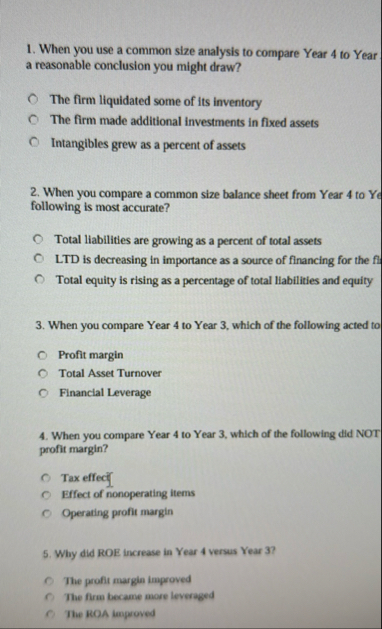

Question: When you use a common size analysis to compare Year 4 to Year a reasonable conclusion you might draw? The firm liquidated some of its

When you use a common size analysis to compare Year to Year a reasonable conclusion you might draw?

The firm liquidated some of its inventory

The firm made additional investments in fixed assets

Intangibles grew as a percent of assets

When you compare a common size balance sheet from Year to Yd following is most accurate?

Total liabilities are growing as a percent of total assets

LTD is decreasing in importance as a source of financing for the fil

Total equity is rising as a percentage of total liabilities and equity

When you compare Year to Year which of the following acted to

Profit margin

Total Asset Turnover

Financial Leverage

When you compare Year to Year which of the following did NOT profit margin?

Tax effect

Effect of nonoperating items

Operating profit margin

Why did ROE increase in Year versus Year

The profit margin improved

The firm became more leveraged

The ROA improved

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock