Question: Where applicable, and if not specifically addressed in the question, assume interest is compounded annually ( i.e. P/Y = 1 ) , at the end

Where applicable, and if not specifically addressed in the question, assume interest is compounded annually ( i.e. P/Y = 1) , at the end of each year. The only exception will be for the mortgage problem (#34), which will have payments and interest calculated on a monthly basis, at the end of each month.

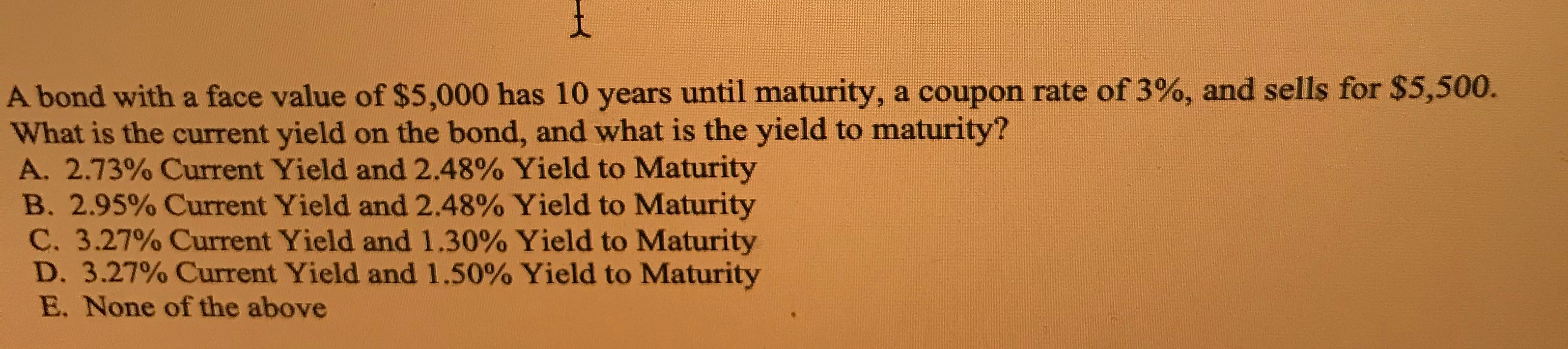

RAR CARA B . SON RARE RE EFERENGER S BAR SESEBRARRRRRRRR ERRARSE RAM ENT RE WELL LAR LEGE ARRO A bond with a face value of $5,000 has 10 years until maturity, a coupon rate of 3%, and sells for $5,500. What is the current yield on the bond, and what is the yield to maturity? A. 2.73% Current Yield and 2.48% Yield to Maturity B. 2.95% Current Yield and 2.48% Yield to Maturity C. 3.27% Current Yield and 1.30% Yield to Maturity D. 3.27% Current Yield and 1.50% Yield to Maturity E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts