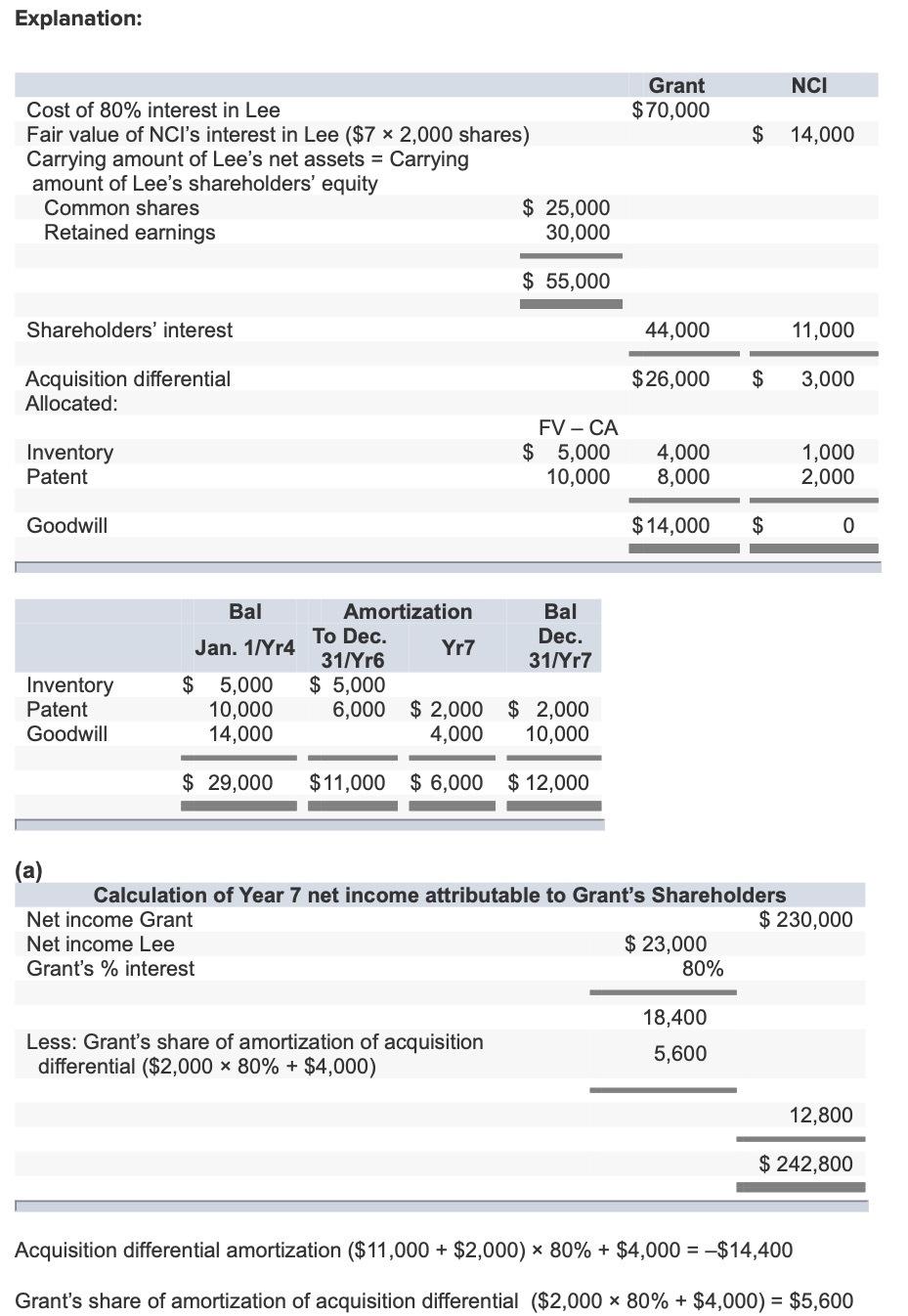

Question: Where are they getting the numbers when calculation the acquisition differential amortization ($11,000, $2000 and $4000. Explain in detail where those numbers came from and

Where are they getting the numbers when calculation the acquisition differential amortization ($11,000, $2000 and $4000.

Explain in detail where those numbers came from and how they were calculated. As well as, where did you get the numbers for shareholders' interest?

Explanation: Cost of 80% interest in Lee Fair value of NCI's interest in Lee ($7 2,000 shares) Carrying amount of Lee's net assets = Carrying amount of Lee's shareholders' equity Common shares Retained earnings Shareholders' interest Acquisition differential Allocated: Inventory Patent Goodwill Inventory Patent Goodwill Bal Jan. 1/Yr4 Amortization To Dec. 31/Yr6 $5,000 Yr7 6,000 $2,000 4,000 $ 25,000 30,000 $ 55,000 Less: Grant's share of amortization of acquisition differential ($2,000 x 80% + $4,000) FV - CA $ 5,000 10,000 $ 5,000 $2,000 10,000 14,000 10,000 $ 29,000 $11,000 $6,000 $12,000 Bal Dec. 31/Yr7 Grant $70,000 44,000 $26,000 8,000 $14,000 $ (a) Calculation of Year 7 net income attributable to Grant's Shareholders Net income Grant Net income Lee Grant's % interest $ 23,000 $ 80% 18,400 5,600 NCI 11,000 $ 3,000 14,000 1,000 2,000 0 $ 230,000 12,800 $ 242,800 Acquisition differential amortization ($11,000+ $2,000) x 80% + $4,000 = $14,400 Grant's share of amortization of acquisition differential ($2,000 x 80% + $4,000) = $5,600

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts