Question: Where can I find the step by step solution to these problems in 10e, page 398?? Chapter Operating Asses Property Pant and Equpment and PEK

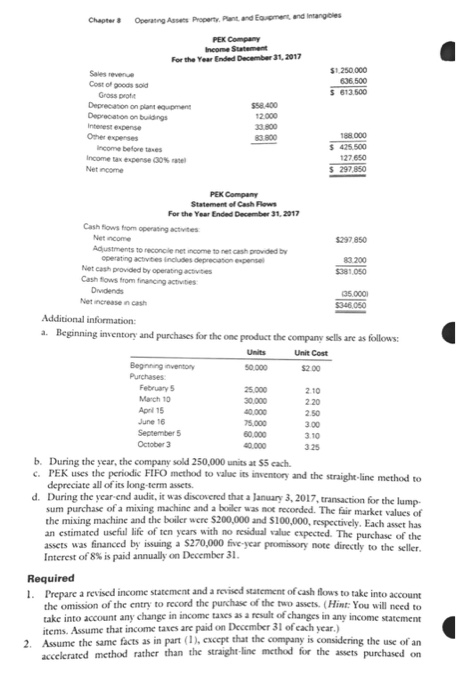

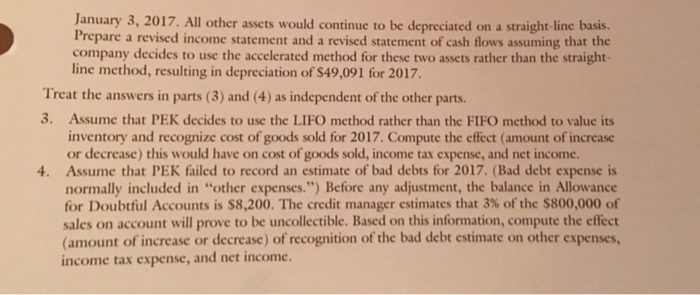

Chapter Operating Asses Property Pant and Equpment and PEK Compary Income Statement For the Year Ended December 31, 2017 Sales revene Cost of goods sold $1 250000 636.500 613.500 Gross profe Deprecaton on buldings Other expenses 558.400 2.000 33 800 83 800 ncome before tases income tax expense a0% rate Net income 188.000 425.500 127.650 S 297,850 PEK Company Statement ef Cash lows For the Year Ended December 31, 2017 Cash flows from operasing actvites Net income Adustments to reconple net income to net cash povided b $297 850 83.200 $381,050 35.000 Net cash provided by operating activites Cash fows from financing activities Drvidends Net increase in cash $346 060 Additional information: Beginning inventory and purchases for the one product the company sells are as follows: a. Unit Cost Begnning inventory $2.00 February 5 Mach 10 Apri 15 June 16 September 5 October 3 25.000 2.10 2 20 2.50 3.00 3.10 325 0.000 5.000 40.000 b. During the year, the company sold 250,000 units at $5 cach c. PEK uses the periodic FIFO method to value its inventory and the straight-line method to depreciate all of its long term assets. During the year-end audit, it was discovered that a January 3,2017, t sum purchase of a mixing machine and a holer was recorded. The fair market values of the mixing machine and the boiler were $200,000 and S1 an estimated useful life of ten years with no residual value expected. The purchase of the assets was financed by issuing a $270,000 five-year promissory note directly to the seller. Interest of 8% is paid annually on December 31 d. transaction for the lump 100,000, respectively. Each asset has Required l. Prepare a revised income statement and a reovised statement of cash flows to take into account the omission of the entry to record the purchase of the two assets(Hin: You will need to take into account any change in income tems. Assume that income taxes are paid on December 31 of each year.) Assume the same facts as in part (1),excepe that the company is considering the use of an accelerated method rather than the straight-line method for the assets purchased on taxes as a result of changes in any income statement 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts