Question: Where did I go wrong? M10-13 Computing the Debt-to-Assets Ratio and the Times Interest Earned Ratio [LO 10-5] The balance sheet for Shaver Corporation reported

Where did I go wrong?

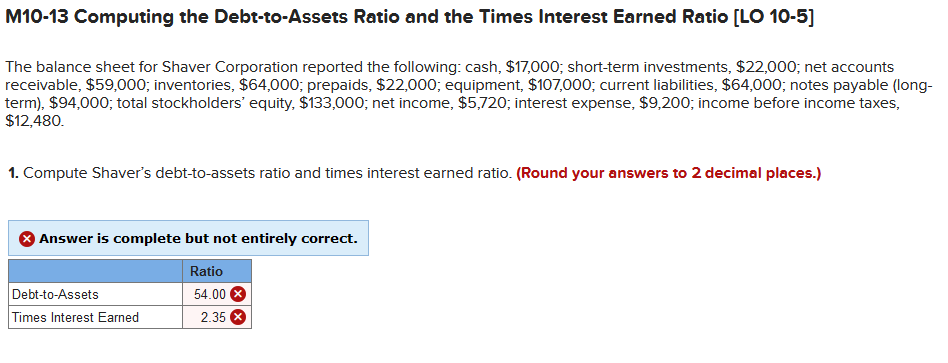

M10-13 Computing the Debt-to-Assets Ratio and the Times Interest Earned Ratio [LO 10-5] The balance sheet for Shaver Corporation reported the following: cash, $17,000; short-term investments, $22,000, net accounts receivable, $59,000; inventories, $64,000; prepaids, $22,000; equipment, $107,000; current liabilities, $64,000; notes payable (long- term), $94,000; total stockholders' equity, $133,000; net income, $5,720; interest expense, $9,200; income before income taxes, $12,480. 1. Compute Shaver's debt-to-assets ratio and times interest earned ratio. (Round your answers to 2 decimal places.) Answer is complete but not entirely correct. Debt-to-Assets Times Interest Earned Ratio 54.00 2.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts