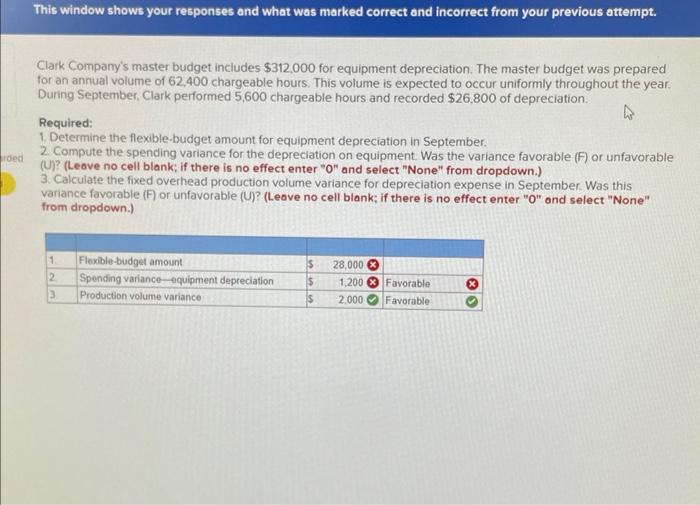

Question: where did i go wrong? please help Clark Company's master budget includes $312,000 for equipment depreciation. The master budget was prepared for an annual volume

Clark Company's master budget includes $312,000 for equipment depreciation. The master budget was prepared for an annual volume of 62,400 chargeable hours. This volume is expected to occur uniformly throughout the year. During September, Clark performed 5,600 chargeable hours and recorded $26,800 of depreciation. Recuired: 1. Determine the flexible-budget amount for equipment depreciation in September. 2. Compute the spending variance for the depreciation on equipment. Was the variance favorable (F) or unfavorable (U)? (Leave no cell blank; if there is no effect enter "O" and select "None" from dropdown.) 3. Calculate the fixed overhead production volume variance for depreciation expense in September. Was this variance favorable (F) or unfavorable (U)? (Leove no cell blank; if there is no effect enter "O" ond select "None" from dropdown.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts