Question: where do I record these transactions in Quick books? please help I will leave a great review!! vendors, and accounts as necessary. All credit card

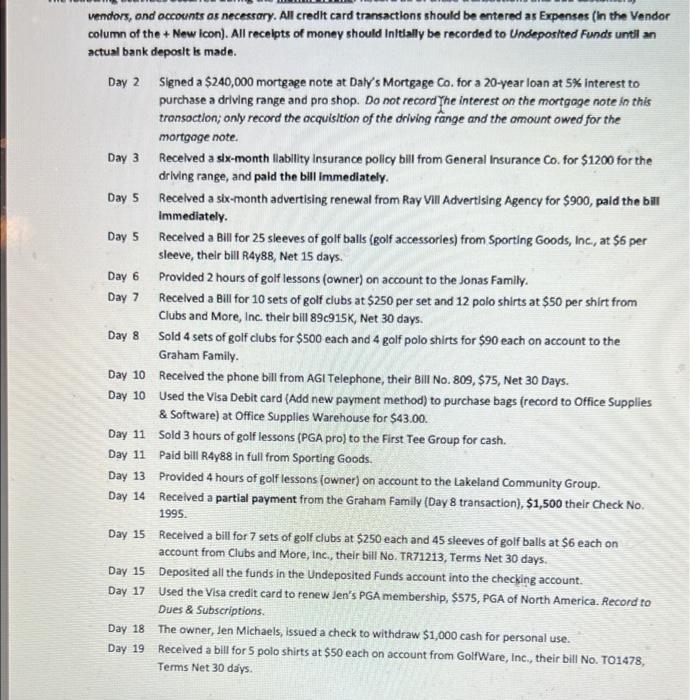

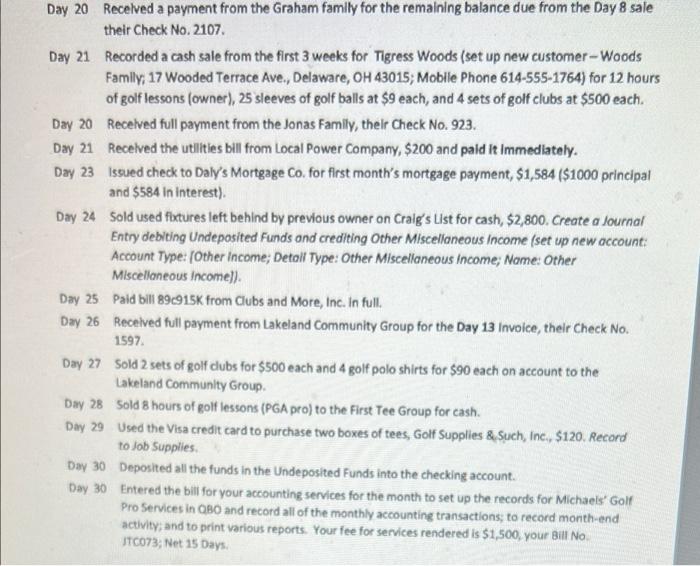

vendors, and accounts as necessary. All credit card transactions should be entered as Expenses (in the Vendor column of the + New icon). All receipts of money should Initially be recorded to Undeposited Funds until an actual bank deposit is made. Day 2 Signed a $240,000 mortgage note at Daly's Mortgage Co. for a 20-year loan at 5% interest to purchase a driving range and pro shop. Do not record The interest on the mortgage note in this transaction; only record the acquisition of the driving range and the amount owed for the mortgage note. Day 3 Received a six-month liability insurance policy bill from General Insurance Co. for $1200 for the driving range, and paid the bill immediately. Day 5 Received a six-month advertising renewal from Ray Vill Advertising Agency for $900, paid the bill immediately. Day 5 Received a Bill for 25 sleeves of golf balls (golf accessories) from Sporting Goods, Inc., at $6 per sleeve, their bill R4y88, Net 15 days. Day 6 Provided 2 hours of golf lessons (owner) on account to the Jonas Family. Day 7 Received a Bill for 10 sets of golf clubs at $250 per set and 12 polo shirts at $50 per shirt from Clubs and More, Inc. their bill 89c915K, Net 30 days. Day 8 Sold 4 sets of golf clubs for $500 each and 4 golf polo shirts for $90 each on account to the Graham Family. Day 10 Received the phone bill from AGI Telephone, their Bill No. 809, $75, Net 30 Days. Day 10 Used the Visa Debit card (Add new payment method) to purchase bags (record to Office Supplies & Software) at Office Supplies Warehouse for $43.00. Day 11 Sold 3 hours of golf lessons (PGA pro) to the First Tee Group for cash. Day 11 Paid bill R4y88 in full from Sporting Goods. Day 13 Provided 4 hours of golf lessons (owner) on account to the Lakeland Community Group. Day 14 Received a partial payment from the Graham Family (Day 8 transaction), $1,500 their Check No. 1995. Day 15 Received a bill for 7 sets of golf clubs at $250 each and 45 sleeves of golf balls at $6 each on account from Clubs and More, Inc., their bill No. TR71213, Terms Net 30 days. Day 15 Deposited all the funds in the Undeposited Funds account into the checking account. Day 17 Used the Visa credit card to renew Jen's PGA membership, $575, PGA of North America. Record to Dues & Subscriptions. Day 18 The owner, Jen Michaels, issued a check to withdraw $1,000 cash for personal use. Day 19 Received a bill for 5 polo shirts at $50 each on account from GolfWare, Inc., their bill No. TO1478, Terms Net 30 days. Day 20 Received a payment from the Graham family for the remaining balance due from the Day 8 sale their Check No. 2107. Day 21 Recorded a cash sale from the first 3 weeks for Tigress Woods (set up new customer-Woods Family; 17 Wooded Terrace Ave., Delaware, OH 43015; Mobile Phone 614-555-1764) for 12 hours of golf lessons (owner), 25 sleeves of golf balls at $9 each, and 4 sets of golf clubs at $500 each. Received full payment from the Jonas Family, their Check No. 923. Day 20 Day 21 Received the utilities bill from Local Power Company, $200 and paid it immediately. Day 23 Issued check to Daly's Mortgage Co. for first month's mortgage payment, $1,584 ($1000 principal and $584 in interest). Day 24 Sold used fixtures left behind by previous owner on Craig's List for cash, $2,800. Create a Journal Entry debiting Undeposited Funds and crediting Other Miscellaneous Income (set up new account: Account Type: [Other Income; Detail Type: Other Miscellaneous Income; Name: Other Miscellaneous Income]). Day 25 Paid bill 89c915K from Clubs and More, Inc. in full. Day 26 Received full payment from Lakeland Community Group for the Day 13 Invoice, their Check No. 1597. Day 27 Sold 2 sets of golf clubs for $500 each and 4 golf polo shirts for $90 each on account to the Lakeland Community Group. Day 28 Sold 8 hours of golf lessons (PGA pro) to the First Tee Group for cash. Day 29 Used the Visa credit card to purchase two boxes of tees, Golf Supplies & Such, Inc., $120. Record to Job Supplies. Day 30 Deposited all the funds in the Undeposited Funds into the checking account. Day 30 Entered the bill for your accounting services for the month to set up the records for Michaels' Golf Pro Services in QBO and record all of the monthly accounting transactions; to record month-end activity; and to print various reports. Your fee for services rendered is $1,500, your Bill No. JTC073; Net 15 Days. vendors, and accounts as necessary. All credit card transactions should be entered as Expenses (in the Vendor column of the + New icon). All receipts of money should Initially be recorded to Undeposited Funds until an actual bank deposit is made. Day 2 Signed a $240,000 mortgage note at Daly's Mortgage Co. for a 20-year loan at 5% interest to purchase a driving range and pro shop. Do not record The interest on the mortgage note in this transaction; only record the acquisition of the driving range and the amount owed for the mortgage note. Day 3 Received a six-month liability insurance policy bill from General Insurance Co. for $1200 for the driving range, and paid the bill immediately. Day 5 Received a six-month advertising renewal from Ray Vill Advertising Agency for $900, paid the bill immediately. Day 5 Received a Bill for 25 sleeves of golf balls (golf accessories) from Sporting Goods, Inc., at $6 per sleeve, their bill R4y88, Net 15 days. Day 6 Provided 2 hours of golf lessons (owner) on account to the Jonas Family. Day 7 Received a Bill for 10 sets of golf clubs at $250 per set and 12 polo shirts at $50 per shirt from Clubs and More, Inc. their bill 89c915K, Net 30 days. Day 8 Sold 4 sets of golf clubs for $500 each and 4 golf polo shirts for $90 each on account to the Graham Family. Day 10 Received the phone bill from AGI Telephone, their Bill No. 809, $75, Net 30 Days. Day 10 Used the Visa Debit card (Add new payment method) to purchase bags (record to Office Supplies & Software) at Office Supplies Warehouse for $43.00. Day 11 Sold 3 hours of golf lessons (PGA pro) to the First Tee Group for cash. Day 11 Paid bill R4y88 in full from Sporting Goods. Day 13 Provided 4 hours of golf lessons (owner) on account to the Lakeland Community Group. Day 14 Received a partial payment from the Graham Family (Day 8 transaction), $1,500 their Check No. 1995. Day 15 Received a bill for 7 sets of golf clubs at $250 each and 45 sleeves of golf balls at $6 each on account from Clubs and More, Inc., their bill No. TR71213, Terms Net 30 days. Day 15 Deposited all the funds in the Undeposited Funds account into the checking account. Day 17 Used the Visa credit card to renew Jen's PGA membership, $575, PGA of North America. Record to Dues & Subscriptions. Day 18 The owner, Jen Michaels, issued a check to withdraw $1,000 cash for personal use. Day 19 Received a bill for 5 polo shirts at $50 each on account from GolfWare, Inc., their bill No. TO1478, Terms Net 30 days. Day 20 Received a payment from the Graham family for the remaining balance due from the Day 8 sale their Check No. 2107. Day 21 Recorded a cash sale from the first 3 weeks for Tigress Woods (set up new customer-Woods Family; 17 Wooded Terrace Ave., Delaware, OH 43015; Mobile Phone 614-555-1764) for 12 hours of golf lessons (owner), 25 sleeves of golf balls at $9 each, and 4 sets of golf clubs at $500 each. Received full payment from the Jonas Family, their Check No. 923. Day 20 Day 21 Received the utilities bill from Local Power Company, $200 and paid it immediately. Day 23 Issued check to Daly's Mortgage Co. for first month's mortgage payment, $1,584 ($1000 principal and $584 in interest). Day 24 Sold used fixtures left behind by previous owner on Craig's List for cash, $2,800. Create a Journal Entry debiting Undeposited Funds and crediting Other Miscellaneous Income (set up new account: Account Type: [Other Income; Detail Type: Other Miscellaneous Income; Name: Other Miscellaneous Income]). Day 25 Paid bill 89c915K from Clubs and More, Inc. in full. Day 26 Received full payment from Lakeland Community Group for the Day 13 Invoice, their Check No. 1597. Day 27 Sold 2 sets of golf clubs for $500 each and 4 golf polo shirts for $90 each on account to the Lakeland Community Group. Day 28 Sold 8 hours of golf lessons (PGA pro) to the First Tee Group for cash. Day 29 Used the Visa credit card to purchase two boxes of tees, Golf Supplies & Such, Inc., $120. Record to Job Supplies. Day 30 Deposited all the funds in the Undeposited Funds into the checking account. Day 30 Entered the bill for your accounting services for the month to set up the records for Michaels' Golf Pro Services in QBO and record all of the monthly accounting transactions; to record month-end activity; and to print various reports. Your fee for services rendered is $1,500, your Bill No. JTC073; Net 15 Days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts