Question: Where does the 6800 DTA come from? emporary Differences, Deferred Tax Liability, Permanent Differences. Synthia Manufacturing Corpora tion reported pre-tax GAAP income of $3,250,000 for

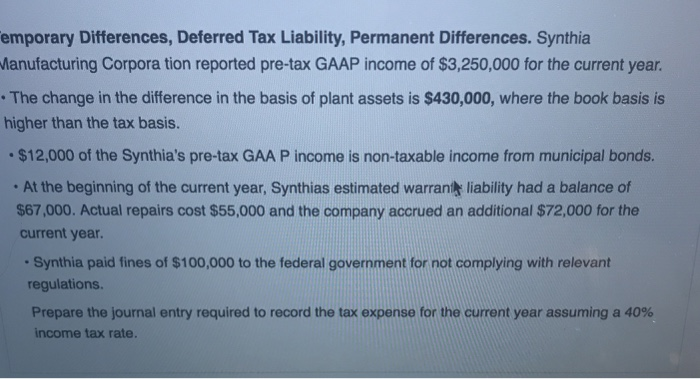

emporary Differences, Deferred Tax Liability, Permanent Differences. Synthia Manufacturing Corpora tion reported pre-tax GAAP income of $3,250,000 for the current year. The change in the difference in the basis of plant assets is $430,000, where the book basis is higher than the tax basis. $12,000 of the Synthia's pre-tax GAA P income is non-taxable income from municipal bonds. At the beginning of the current year, Synthias estimated warrant liability had a balance of $67,000. Actual repairs cost $55,000 and the company accrued an additional $72,000 for the current year. Synthia paid fines of $100,000 to the federal government for not complying with relevant regulations. Prepare the journal entry required to record the tax expense for the current year assuming a 40% ncome tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts