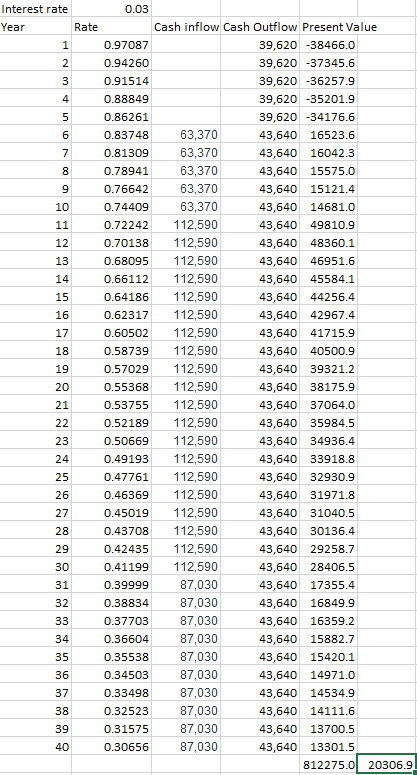

Question: Where is wrong? 0.03 Interest rate Year Rate 2 16 17 Cash inflow Cash Outflow Present Value 0.97087 39,620 -38466.0 0.94260 39,620 -37345.6 0.91514 39,620

Where is wrong?

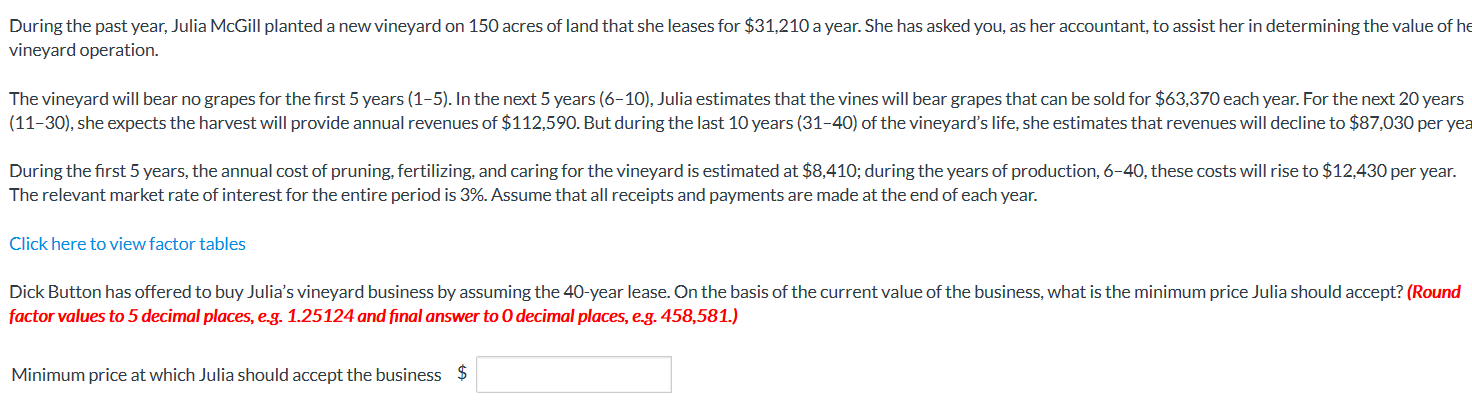

0.03 Interest rate Year Rate 2 16 17 Cash inflow Cash Outflow Present Value 0.97087 39,620 -38466.0 0.94260 39,620 -37345.6 0.91514 39,620 -36257.9 0.88849 39,620 -35201.9 0.86261 39,620 -34176.6 0.83748 63,370 43,640 16523.6 0.81309 63,370 43,640 16042.3 0.78941 63,370 43,640 15575.0 0.76642 63,370 43,640 15121.4 0.74409 63,370 43,640 14681.0 0.72242 112,590 43,640 49810.9 0.70138 112,590 43,640 48360.1 0.68095 112.590 43,640 46951.6 0.66112 112.590 43,640 45584.1 0.64186 112,590 43,640 44256.4 0.62317 112,590 43,640 42967.4 0.60502 112,590 43,640 41715.9 0.58739 112,590 43,640 40500.9 0.57029 112,590 43,640 39321.2 0.55368 112,590 43,640 38175.9 0.53755 112,590 43,640 37064.0 0.52189 112,590 43,640 35984.5 0.50669 112,590 43,640 34936.4 0.49193 112,590 43,640 33918.8 0.47761 112,590 43,640 32930.9 0.46369 112,590 43,640 31971.8 0.45019 112,590 43,640 31040.5 0.43708 112,590 43,640 30136.4 0.42435 112,590 43,640 29258.7 0.41199 112,590 43,640 28406.5 0.39999 87,030 43,640 17355.4 0.38834 87,030 43,640 16849.9 0.37703 87,030 43,640 16359.2 0.36604 87,030 43,640 15882.7 0.35538 87,030 43,640 15420.1 0.34503 87,030 43,640 14971.0 0.33498 87,030 43,640 14534.9 0.32523 87,030 43,640 14111.6 0.31575 87,030 43,640 13700.5 0.30656 87,030 43,640 13301.5 812275.0 20306.9 40 During the past year, Julia McGill planted a new vineyard on 150 acres of land that she leases for $31,210 a year. She has asked you, as her accountant, to assist her in determining the value of he vineyard operation. The vineyard will bear no grapes for the first 5 years (1-5). In the next 5 years (6-10), Julia estimates that the vines will bear grapes that can be sold for $63,370 each year. For the next 20 years (11-30), she expects the harvest will provide annual revenues of $112,590. But during the last 10 years (31-40) of the vineyard's life, she estimates that revenues will decline to $87,030 per yea During the first 5 years, the annual cost of pruning, fertilizing, and caring for the vineyard is estimated at $8,410; during the years of production, 6-40, these costs will rise to $12,430 per year. The relevant market rate of interest for the entire period is 3%. Assume that all receipts and payments are made at the end of each year. Click here to view factor tables Dick Button has offered to buy Julia's vineyard business by assuming the 40-year lease. On the basis of the current value of the business, what is the minimum price Julia should accept? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, eg. 458,581.) Minimum price at which Julia should accept the business $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts