Question: where N(x) is the cumulative probability distribution function for a standardized normal distribution and di and d2 are parameters dependent on the structure of the

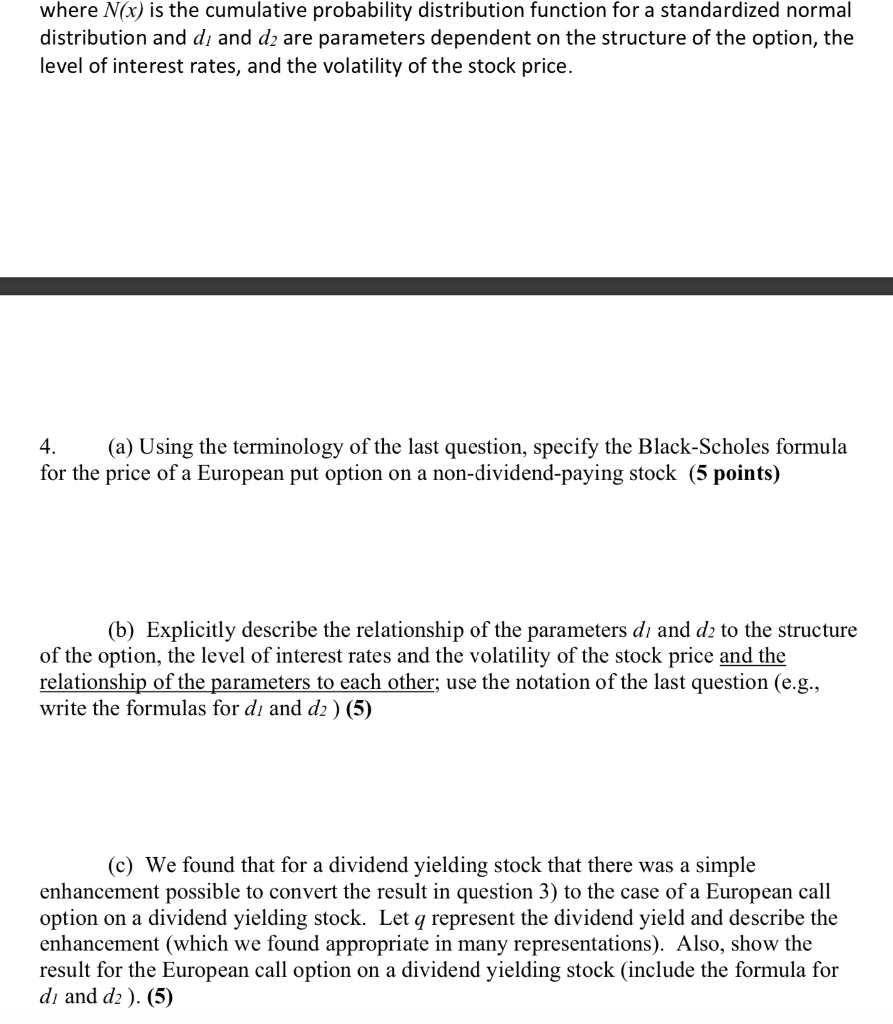

where N(x) is the cumulative probability distribution function for a standardized normal distribution and di and d2 are parameters dependent on the structure of the option, the level of interest rates, and the volatility of the stock price. 4. (a) Using the terminology of the last question, specify the Black-Scholes formula for the price of a European put option on a non-dividend-paying stock (5 points) (b) Explicitly describe the relationship of the parameters di and d2 to the structure of the option, the level of interest rates and the volatility of the stock price and the relationship of the parameters to each other; use the notation of the last question (e.g., write the formulas for di and d2 ) (5) (c) We found that for a dividend yielding stock that there was a simple enhancement possible to convert the result in question 3) to the case of a European call option on a dividend yielding stock. Let q represent the dividend yield and describe the enhancement (which we found appropriate in many representations). Also, show the result for the European call option on a dividend yielding stock (include the formula for di and d2 ). (5) where N(x) is the cumulative probability distribution function for a standardized normal distribution and di and d2 are parameters dependent on the structure of the option, the level of interest rates, and the volatility of the stock price. 4. (a) Using the terminology of the last question, specify the Black-Scholes formula for the price of a European put option on a non-dividend-paying stock (5 points) (b) Explicitly describe the relationship of the parameters di and d2 to the structure of the option, the level of interest rates and the volatility of the stock price and the relationship of the parameters to each other; use the notation of the last question (e.g., write the formulas for di and d2 ) (5) (c) We found that for a dividend yielding stock that there was a simple enhancement possible to convert the result in question 3) to the case of a European call option on a dividend yielding stock. Let q represent the dividend yield and describe the enhancement (which we found appropriate in many representations). Also, show the result for the European call option on a dividend yielding stock (include the formula for di and d2 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts