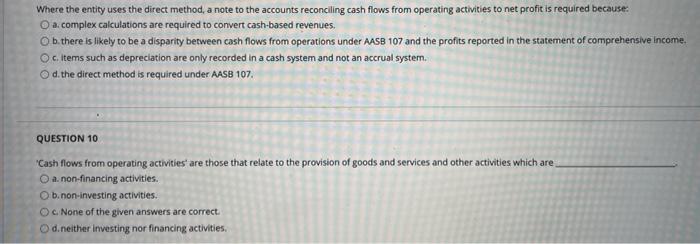

Question: Where the entity uses the direct method, a note to the accounts reconciling cash flows from operating activities to net profit is required because: a.

Where the entity uses the direct method, a note to the accounts reconciling cash flows from operating activities to net profit is required because: a. complex calculations are required to convert cash-based revenues, b. there is likely to be a disparity between cash flows from operations under AASB 107 and the profits reported in the statement of comprehensive income. c. items such as depreciation are only recorded in a cash system and not an accrual system. d. the direct method is required under AASB 107. QUESTION 10 'Cash flows from operating activities' are those that relate to the provision of goods and services and other activities which are a. non-financing activities. b. non-investing activities. ci None of the given answers are correct. dineither investing nor financing activities. Where the entity uses the direct method, a note to the accounts reconciling cash flows from operating activities to net profit is required because: a. complex calculations are required to convert cash-based revenues, b. there is likely to be a disparity between cash flows from operations under AASB 107 and the profits reported in the statement of comprehensive income. c. items such as depreciation are only recorded in a cash system and not an accrual system. d. the direct method is required under AASB 107. QUESTION 10 'Cash flows from operating activities' are those that relate to the provision of goods and services and other activities which are a. non-financing activities. b. non-investing activities. ci None of the given answers are correct. dineither investing nor financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts