Question: wheres number 2, the expert that answer me back never answet that question and is this complete it looks short? Other data: 1 A physical

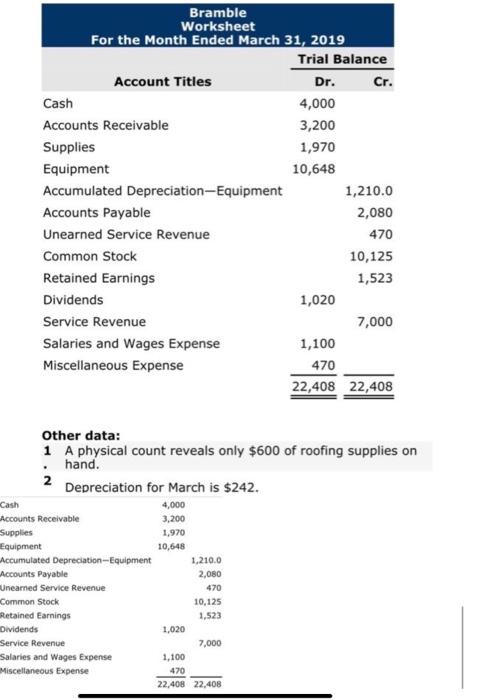

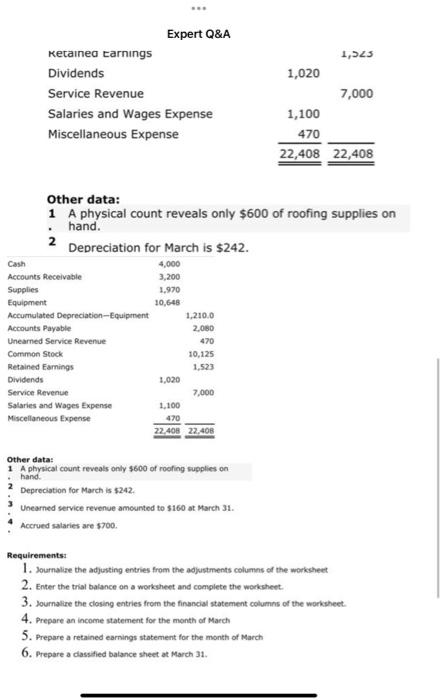

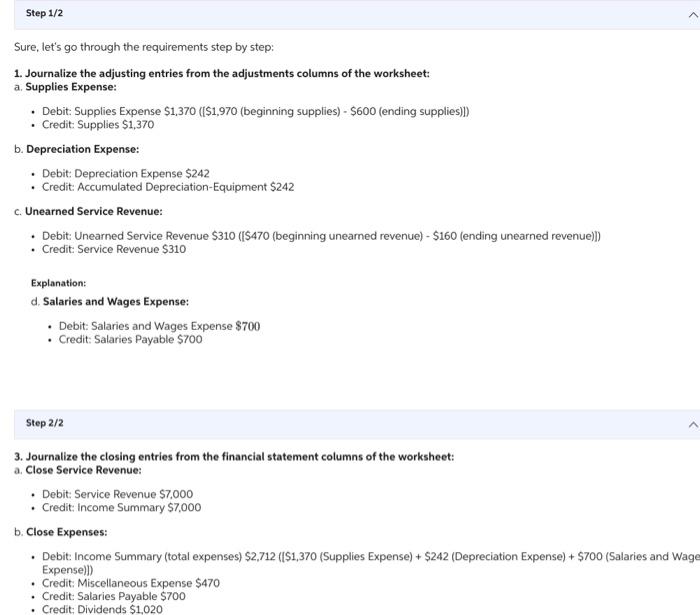

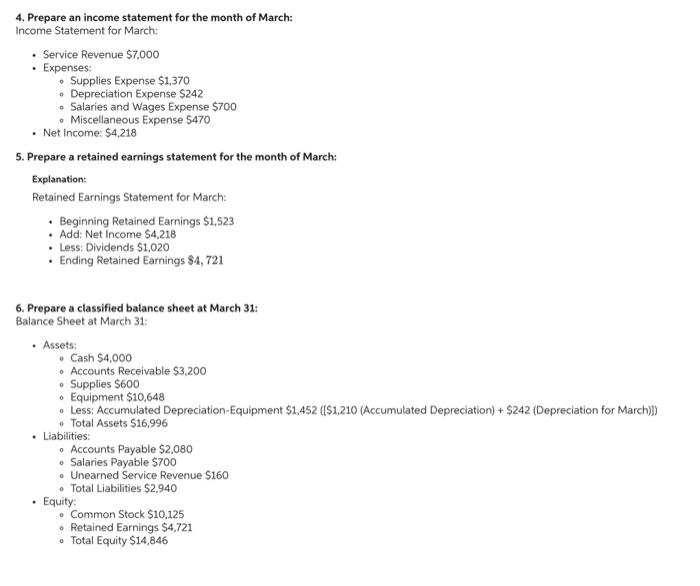

Other data: 1 A physical count reveals only $600 of roofing supplies on hand. 2 Depreciation for March is $242 Other data: 1 A physical count reveals only $600 of roofing supplies on hand. 2 Depreciation for March is $242. Other data: 1 A physical count reveals only $600 of roofing supplies on harnd. 2 Depreciation for March is $242. 3 Unearned service revenue amounted to $160 at March 31 . 4 Accrued salaries are $700. Requirementst 1. Journaliae the adjusting entries from the adjustments columns of the worksheet 2. Enter the trial balance on a worksheet and complete the worksheet. 3. Journalize the closing entries from the financial statement columns of the worksheet. 4. Prepare an income statement for the month of March 5. Prepare a retained earnings statement for the month of March 6. Prepare a classified balance sheet at March 31. 4. Prepare an income statement for the month of March: Income Statement for March: - Service Revenue $7,000 - Expenses: - Supplies Expense $1,370 - Depreciation Expense \$242 - Salaries and Wages Expense $700 - Miscellaneous Expense $470 - Net Income: $4,218 5. Prepare a retained earnings statement for the month of March: Explanation: Retained Earnings Statement for March: - Beginning Retained Earnings \$1,523 - Add: Net Income $4,218 - Less: Dividends \$1,020 - Ending Retained Earnings \$4, 721 6. Prepare a classified batance sheet at March 31: Balance Sheet at March 31: - Assets: - Cash $4,000 - Accounts Receivable $3,200 - Supplies $600 - Equipment $10,648 - Less: Accumulated Depreciation-Equipment \$1,452 ([\$1,210 (Accumulated Depreciation) + \$242 (Depreciation for March)]) - Total Assets $16,996 - Liabilities: - Accounts Payable $2,080 - Salaries Payable $700 - Unearned Service Revenue $160 - Total Liabilities $2,940 - Equity: - Common Stock \$10,125 - Retained Earnings $4,721 - Total Equity $14,846 Sure, let's go through the requirements step by step: 1. Journalize the adjusting entries from the adjustments columns of the worksheet: a. Supplies Expense: - Debit: Supplies Expense $1,370 ([\$1,970 (beginning supplies) - $600 (ending supplies)]) - Credit: Supplies $1,370 b. Depreciation Expense: - Debit: Depreciation Expense $242 - Credit: Accumulated Depreciation-Equipment $242 c. Unearned Service Revenue: - Debit: Unearned Service Revenue $310 ([\$470 (beginning unearned revenue) - $160 (ending unearned revenue)]) - Credit: Service Revenue $310 Explanation: d. Salaries and Wages Expense: - Debit: Salaries and Wages Expense $700 - Credit: Salaries Payable $700 Step 2/2 3. Journalize the closing entries from the financial statement columns of the worksheet: a. Close Service Revenue: - Debit: Service Revenue $7,000 - Credit: income Summary $7,000 b. Close Expenses: - Debit: Income Summary (total expenses) \$2,712 ([\$1,370 (Supplies Expense) + \$242 (Depreciation Expense) + \$700 (Salaries and Wag Expense)]) - Credit: Miscellaneous Expense $470 - Credit Salaries Payable $700 - Credit: Dividends $1,020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts