Question: - Which accounts should be credited or debited using journal entries? I have listed the accounts below and some I tried doing I wasn't sure

- Which accounts should be credited or debited using journal entries? I have listed the accounts below and some I tried doing I wasn't sure if they are right or wrong, so can someone help me please.

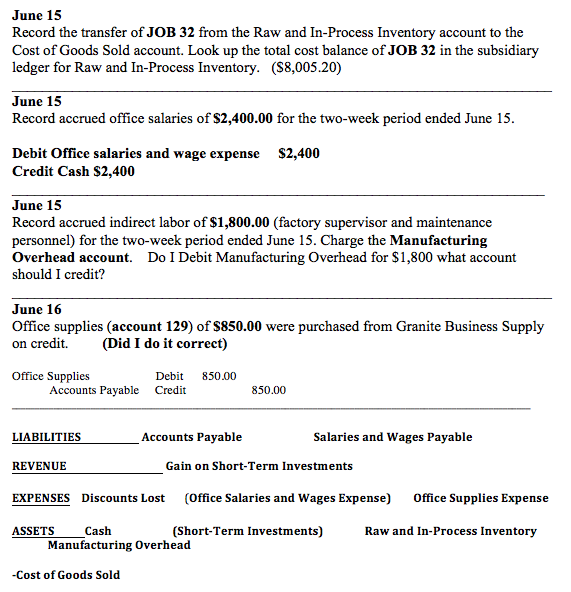

June 15 Record the transfer of JOB 32 from the Raw and In-Process Inventory account to the Cost of Goods Sold account. Look up the total cost balance of JOB 32 in the subsidiary ledger for Raw and In-Process Inventory. (S8,005.20) June 15 Record accrued office salaries of $2,400.00 for the two-week period ended June 15 S2,400 Debit Office salaries and wage expense Credit Cash S2,400 June 15 Record accrued indirect labor of $1,800.00 (factory supervisor and maintenance personnel) for the two-week period ended June 15. Charge the Manufacturing Overhead account. Do I Debit Manufacturing Overhead for $1,800 what account should I credit? June 16 Office supplies (account 129) of $850.00 were purchased from Granite Business Supply on credit.(Did I do it correct) Office Supplies Debit 850.00 Accounts Payable Credit 850.00 Accounts Payable Salaries and Wages Payable LIABILITIES REVENUE EXPENSES Gain on Short-Term Investments Discounts Lost (Office Salaries and Wages Expense) Office Supplies Expense ASSETS Cash (Short-Term Investments) Raw and In-Process Inventory Manufacturing Overhead -Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts