Question: Which accounts should be credited or debited using journal entries? - 628 License Expense - 603 Truck Operating Expense - 139 Trucks - 140 Accumulated

Which accounts should be credited or debited using journal entries?

- 628 License Expense

- 603 Truck Operating Expense

- 139 Trucks

- 140 Accumulated Depreciation, Trucks

- 603 Truck Operating Expense

- 615 Depreciation Expense, Trucks

- 101 Cash

- 721 Gain on Sale of Assets

- 129 Office Supplies

- 131 Office Equipment

- 132 Accumulated Depreciation, Office Equipment

- 602 Office Supplies Expense

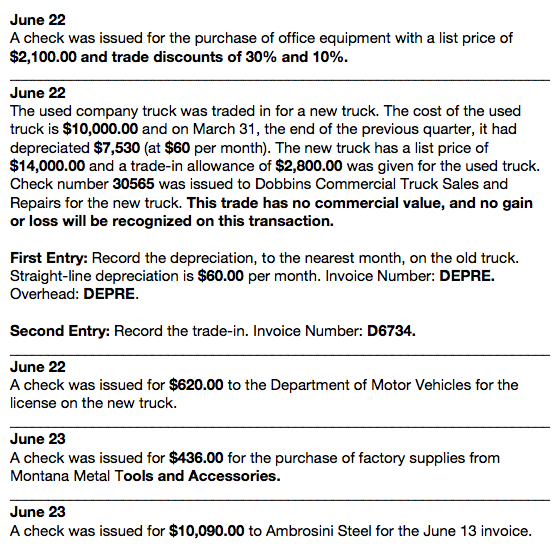

A check was issued for the purchase of office equipment with a list price of $2,100.00 and trade discounts of 30% and 10%. June 22 The used company truck was traded in for a new truck. The cost of the used truck is $10,000.00 and on March 31, the end of the previous quarter, it had depreciated $7,530 (at $60 per month). The new truck has a list price of $14,000.00 and a trade-in allowance of $2,800.00 was given for the used truck. Check number 30565 was issued to Dobbins Commercial Truck Sales and Repairs for the new truck. This trade has no commercial value, and no gain or loss will be recognized on this transaction. First Entry: Record the depreciation, to the nearest month, on the old truck. Straight-line depreciation is $60.00 per month. Invoice Number: DEPRE. Overhead: DEPRE. Second Entry: Record the trade-in. Invoice Number: D6734. June 22 A check was issued for $620.00 to the Department of Motor Vehicles for the license on the new truck. June 23 A check was issued for $436.00 for the purchase of factory supplies from Montana Metal Tools and Accessories. June 23 A check was issued for $10,090.00 to Ambrosini Steel for the June 13 invoice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts