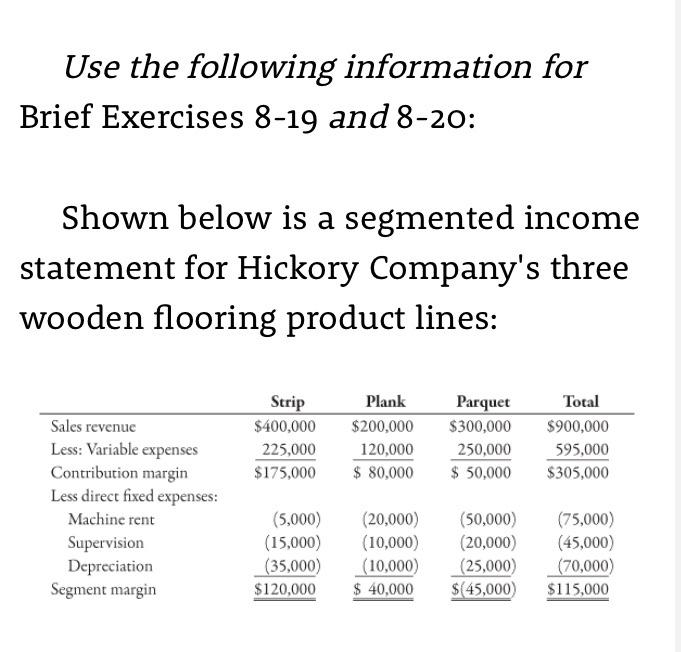

Question: which alternative is cost efficient and by how much. Use the following information for Brief Exercises 8-19 and 8-20: Shown below is a segmented income

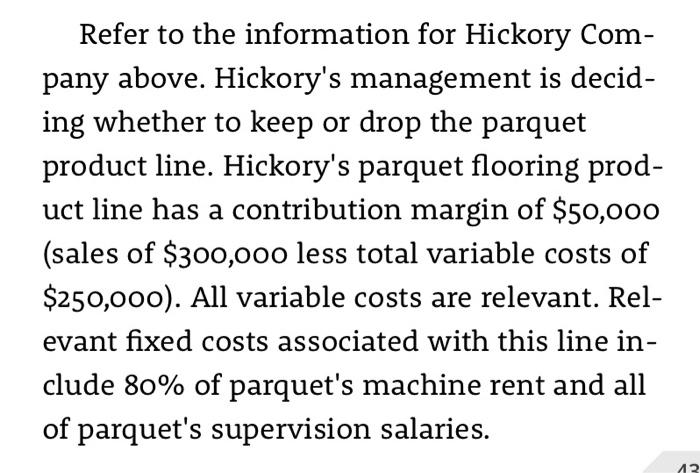

Use the following information for Brief Exercises 8-19 and 8-20: Shown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip $400,000 225,000 $175,000 Plank $200,000 120,000 $ 80,000 Parquet $300,000 250,000 $ 50,000 Total $900,000 595,000 $305,000 Sales revenue Less: Variable expenses Contribution margin Less direct fixed expenses: Machine rent Supervision Depreciation Segment margin (5,000) (15,000) (35,000) $120,000 (20,000) (10,000 (10,000) $ 40,000 (50,000) (20,000) (25,000) $(45,000 (75,000) (45,000) (70,000) $115,000 Refer to the information for Hickory Com- pany above. Hickory's management is decid- ing whether to keep or drop the parquet product line. Hickory's parquet flooring prod- uct line has a contribution margin of $50,000 (sales of $300,000 less total variable costs of $250,000). All variable costs are relevant. Rel- evant fixed costs associated with this line in- clude 80% of parquet's machine rent and all of parquet's supervision salaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts