Question: Which answer is correct? Question 14 1.7 points Saved IndirecTV, Inc. currently has 10 million common stock shares outstanding. Over the next 3 years, the

Which answer is correct?

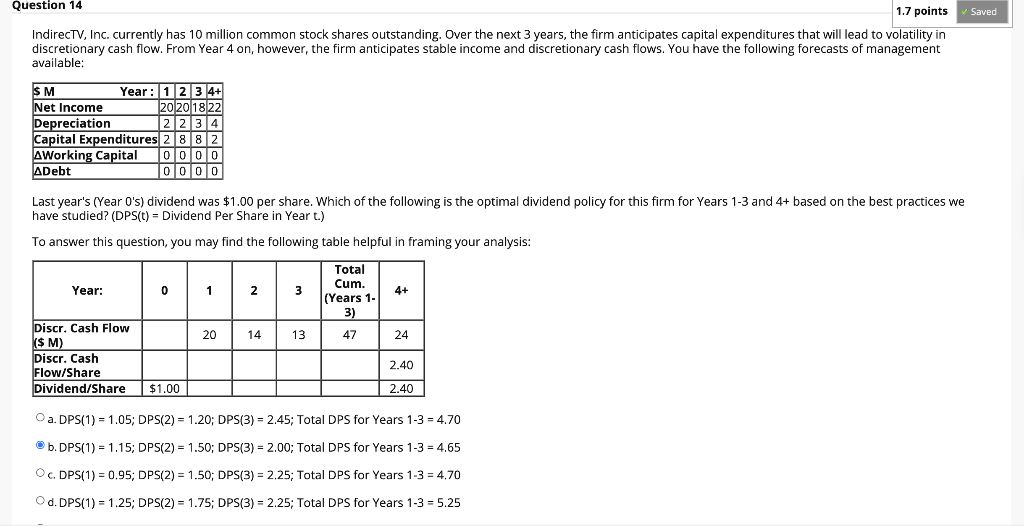

Question 14 1.7 points Saved IndirecTV, Inc. currently has 10 million common stock shares outstanding. Over the next 3 years, the firm anticipates capital expenditures that will lead to volatility in discretionary cash flow. From Year 4 on, however, the firm anticipates stable income and discretionary cash flows. You have the following forecasts of management available: SM Year: 1 2 3 4+ Net Income 20 2018 22 Depreciation 2234 Capital Expenditures 2 882 AWorking Capital 0000 ADebt 0000 Last year's (Year O's) dividend was $1.00 per share. Which of the following is the optimal dividend policy for this firm for Years 1-3 and 4+ based on the best practices we have studied? (DPS(t) = Dividend Per Share in Yeart.) To answer this question, you may find the following table helpful in framing your analysis: Year: 0 1 2 3 Total Cum. (Years 1- 3) 4+ 20 14 13 47 24 Discr. Cash Flow k$ M) Discr. Cash Flow/Share Dividend/Share 2.40 $1.00 2.40 a.DPS(1) = 1.05; DPS(2) = 1.20; DPS(3) = 2.45; Total DPS for Years 1-3 = 4.70 b. DPS(1) = 1.15; DPS(2) = 1.50; DPS(3) = 2.00; Total DPS for Years 1-3 = 4.65 OC.DPS(1) = 0.95; DPS(2) = 1.50; DPS(3) = 2,25; Total DPS for Years 1-3 = 4.70 Od. DPS(1) = 1.25; DPS(2) = 1.75; DPS(3) = 2.25; Total DPS for Years 1-3 = 5.25 Question 14 1.7 points Saved IndirecTV, Inc. currently has 10 million common stock shares outstanding. Over the next 3 years, the firm anticipates capital expenditures that will lead to volatility in discretionary cash flow. From Year 4 on, however, the firm anticipates stable income and discretionary cash flows. You have the following forecasts of management available: SM Year: 1 2 3 4+ Net Income 20 2018 22 Depreciation 2234 Capital Expenditures 2 882 AWorking Capital 0000 ADebt 0000 Last year's (Year O's) dividend was $1.00 per share. Which of the following is the optimal dividend policy for this firm for Years 1-3 and 4+ based on the best practices we have studied? (DPS(t) = Dividend Per Share in Yeart.) To answer this question, you may find the following table helpful in framing your analysis: Year: 0 1 2 3 Total Cum. (Years 1- 3) 4+ 20 14 13 47 24 Discr. Cash Flow k$ M) Discr. Cash Flow/Share Dividend/Share 2.40 $1.00 2.40 a.DPS(1) = 1.05; DPS(2) = 1.20; DPS(3) = 2.45; Total DPS for Years 1-3 = 4.70 b. DPS(1) = 1.15; DPS(2) = 1.50; DPS(3) = 2.00; Total DPS for Years 1-3 = 4.65 OC.DPS(1) = 0.95; DPS(2) = 1.50; DPS(3) = 2,25; Total DPS for Years 1-3 = 4.70 Od. DPS(1) = 1.25; DPS(2) = 1.75; DPS(3) = 2.25; Total DPS for Years 1-3 = 5.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts