Question: WHICH ARE THE CORRECT ANSWERS? Description Term Answer Replacement A. The term used to describe the time necessary to recover the original cost decision of

WHICH ARE THE CORRECT ANSWERS?

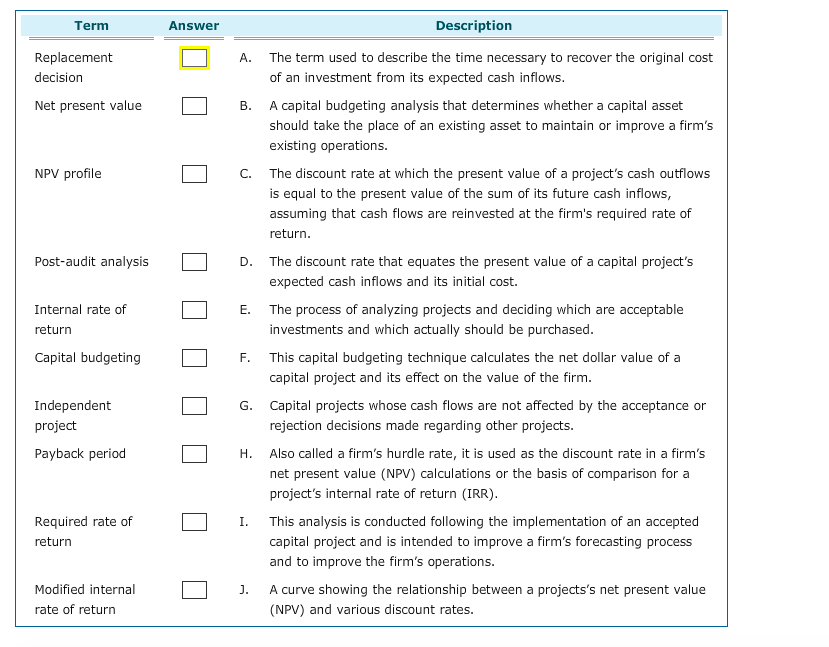

Description Term Answer Replacement A. The term used to describe the time necessary to recover the original cost decision of an investment from its expected cash inflows Net present value B. A capital budgeting analysis that determines whether a capital asset should take the place of an existing asset to maintain or improve a firm's existing operations. NPV profile C. The discount rate at which the present value of a project's cash outflows is equal to the present value of the sum of its future cash inflows, assuming that cash flows are reinvested at the firm's required rate of return Post-audit analysis D. The discount rate that equates the present value of a capital project's expected cash inflows and its initial cost. Internal rate of E. The process of analyzing projects and deciding which are acceptable investments and which actually should be purchased. return Capital budgeting F. This capital budgeting technique calculates the net dollar value of a capital project and its effect on the value of the firm Independent G. Capital projects whose cash flows are not affected by the acceptance or project rejection decisions made regarding other projects. Payback period H. Also called a firm's hurdle rate, it is used as the discount rate in a firm's net present value (NPV) calculations or the basis of comparison for a project's internal rate of return (IRR). Required rate of I. This analysis is conducted following the implementation of an accepted capital project and is intended to improve a firm's forecasting process return and to improve the firm's operations. Modified internal J. A curve showing the relationship between a projects's net present value rate of return (NPV) and various discount rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts