Question: Which assertion about statement 1 and statement 2 is true? tement 1: Based on the information in the following table and applying the pure play

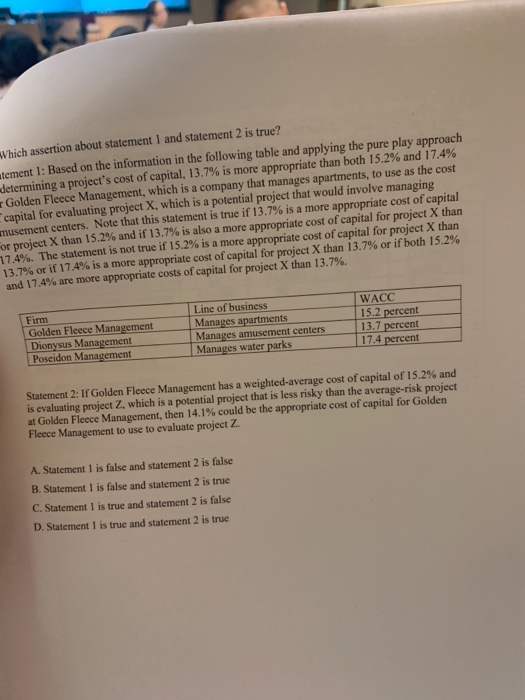

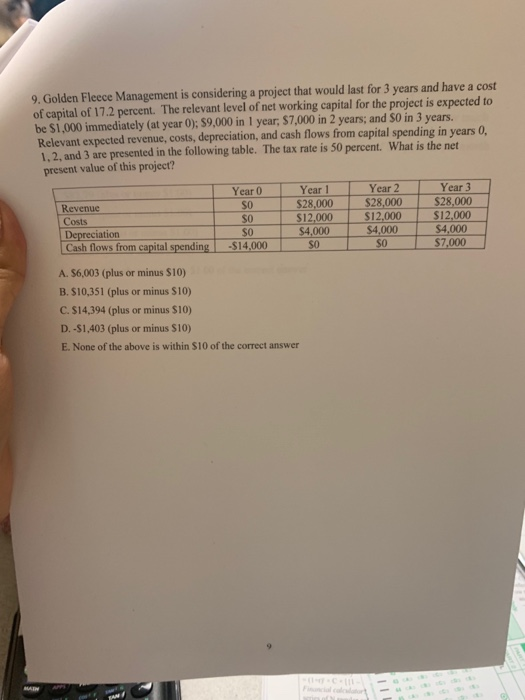

Which assertion about statement 1 and statement 2 is true? tement 1: Based on the information in the following table and applying the pure play approach determining a project's cost of capital, 13.7% is more appropriate than both 15.2% and 17.4% Golden Fleece Management, which is a company that manages apartments, to use as the cost capital for evaluating project X, which is a potential project that would involve managing musement centers. Note that this statement is true if 13.7% is a more appropriate cost of capital For project X than 15.2% and if 13.7% is also a more appropriate cost of capital for project X than 17.4%. The statement is not true if 15.2% is a more appropriate cost of capital for project X than 13.7% or if 17.4% is a more appropriate cost of capital for project X than 13.7% or if both 15.2% and 17.4% are more appropriate costs of capital for project X than 13.7%. Firm WACC 15.2 percent 13.7 percent 17.4 percent Line of business Manages apartments Manages amusement centers Manages water parks Golden Fleece Management Dionysus Management Poseidon Management Statement 2: If Golden Fleece Management has a weighted average cost of capital of 15.2% and is evaluating project Z, which is a potential project that is less risky than the average-risk project at Golden Fleece Management, then 14.1% could be the appropriate cost of capital for Golden Fleece Management to use to evaluate project Z. A. Statement 1 is false and statement 2 is false B. Statement 1 is false and statement 2 is true C. Statement is true and statement 2 is false D. Statement 1 is true and statement 2 is true 9. Golden Fleece Management is considering a project that would last for 3 years and have a cost of capital of 17.2 percent. The relevant level of net working capital for the project is expected to be $1.000 immediately (at year 0); $9,000 in 1 year, $7,000 in 2 years; and 50 in 3 years. Relevant expected revenue, costs, depreciation, and cash flows from capital spending in years 0. 1,2, and 3 are presented in the following table. The tax rate is 50 percent. What is the net present value of this project? Year SO Revenue Costs Depreciation Cash flows from capital spending Year 1 $28,000 S12.000 $4,000 SO Year 2 $28,000 S12,000 $4,000 SO Year 3 $28,000 $12,000 $4.000 $7,000 SO -$14,000 A. 56,003 (plus or minus 510) B. $10,351 (plus or minus 510) C. $14,394 (plus or minus $10) D.-S1,403 (plus or minus $10) E. None of the above is within S10 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts