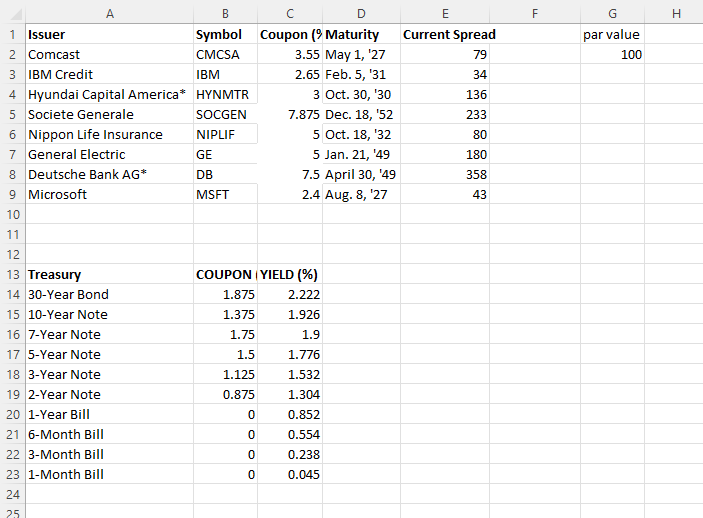

Question: Which bond has the highest yield? Determine the yield to maturity on these bonds using the spread. If dont have a comparable maturity Treasury rate

Which bond has the highest yield?

Determine the yield to maturity on these bonds using the spread.

If dont have a comparable maturity Treasury rate then go up to the next highest, e.g. IBM bond matures in 9 years so use the 10 year Treasury rate.

Once you have the YTM calculate the price for each of the bonds. Which bond has the highest price? Why doesnt the highest price correspond to the lowest yield?

Please provide cell reference.

F G H E Current Spread 79 34 par value 100 136 233 80 180 358 43 A B D 1 Issuer Symbol Coupon (> Maturity 2 Comcast CMCSA 3.55 May 1, '27 3 IBM Credit IBM 2.65 Feb. 5, '31 4 Hyundai Capital America* HYNMTR 3 Oct. 30, 30 5 Societe Generale SOCGEN 7.875 Dec. 18, 52 6 Nippon Life Insurance NIPLIF 5 Oct. 18, 32 7 General Electric GE 5 Jan. 21, 49 8 Deutsche Bank AG* DB 7.5 April 30, 49 9 Microsoft MSFT 2.4 Aug. 8,27 10 11 12 13 Treasury COUPON YIELD (%) 14 30-Year Bond 1.875 2.222 15 10-Year Note 1.375 1.926 16 7-Year Note 1.75 1.9 17 5-Year Note 1.5 1.776 18 3-Year Note 1.125 1.532 19 2-Year Note 0.875 1.304 20 1-Year Bill 0 0.852 21 6-Month Bill 0 0.554 22 3-Month Bill 0 0.238 23 1-Month Bill 0 0.045 24 25 F G H E Current Spread 79 34 par value 100 136 233 80 180 358 43 A B D 1 Issuer Symbol Coupon (> Maturity 2 Comcast CMCSA 3.55 May 1, '27 3 IBM Credit IBM 2.65 Feb. 5, '31 4 Hyundai Capital America* HYNMTR 3 Oct. 30, 30 5 Societe Generale SOCGEN 7.875 Dec. 18, 52 6 Nippon Life Insurance NIPLIF 5 Oct. 18, 32 7 General Electric GE 5 Jan. 21, 49 8 Deutsche Bank AG* DB 7.5 April 30, 49 9 Microsoft MSFT 2.4 Aug. 8,27 10 11 12 13 Treasury COUPON YIELD (%) 14 30-Year Bond 1.875 2.222 15 10-Year Note 1.375 1.926 16 7-Year Note 1.75 1.9 17 5-Year Note 1.5 1.776 18 3-Year Note 1.125 1.532 19 2-Year Note 0.875 1.304 20 1-Year Bill 0 0.852 21 6-Month Bill 0 0.554 22 3-Month Bill 0 0.238 23 1-Month Bill 0 0.045 24 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts