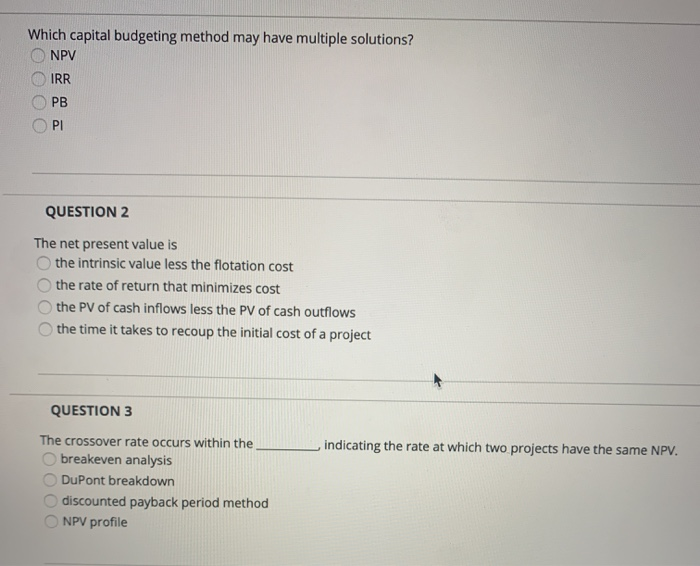

Question: Which capital budgeting method may have multiple solutions? ONPV O IRR OPB OPI QUESTION 2 The net present value is O the intrinsic value less

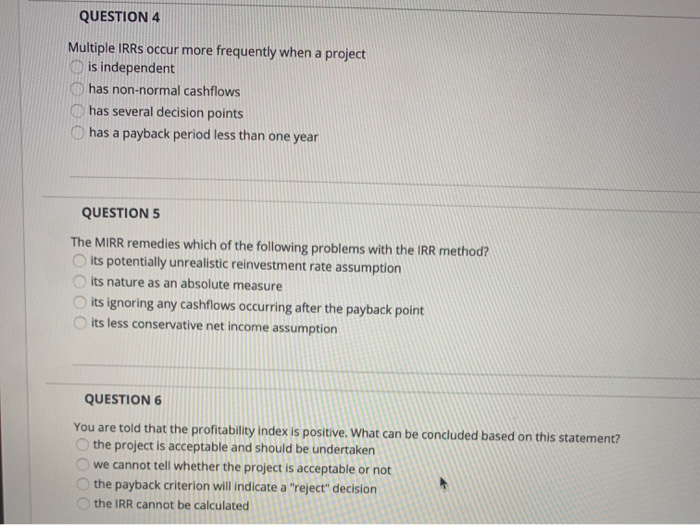

Which capital budgeting method may have multiple solutions? ONPV O IRR OPB OPI QUESTION 2 The net present value is O the intrinsic value less the flotation cost the rate of return that minimizes cost the PV of cash inflows less the PV of cash outflows the time it takes to recoup the initial cost of a project QUESTION 3 indicating the rate at which two projects have the same NPV. The crossover rate occurs within the breakeven analysis DuPont breakdown discounted payback period method NPV profile QUESTION 4 Multiple IRRs occur more frequently when a project is independent has non-normal cashflows has several decision points has a payback period less than one year QUESTION 5 The MIRR remedies which of the following problems with the IRR method? its potentially unrealistic reinvestment rate assumption its nature as an absolute measure its ignoring any cashflows occurring after the payback point its less conservative net income assumption QUESTION 6 You are told that the profitability Index is positive. What can be concluded based on this statement? the project is acceptable and should be undertaken we cannot tell whether the project is acceptable or not the payback criterion will indicate a "reject" decision the IRR cannot be calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts